Many people are attracted to Forex trading because of the possibility of obtaining high leverage, which is the ability to use other people's money to trade. But not all traders understand what leverage is, how it works, and how it can affect their profits.

In this article, we will look at the advantages of using leveraged capital for trading and show that using leverage in your Forex trading strategy can have both positive and negative effects.

Knowing about these points in advance is imperative, especially if you will use automatic trading. Even using the best Forex robots in your work requires a skillful approach, and without understanding what's leverage in Forex, automatic trading can lead to significant risks. So, when you switch from a demo account to real trading, you should already understand what is Forex leverage and how to use it to your advantage.

Leverage Trading Definition

Leverage meaning in Forex: it is the percentage of real money in the account, which is less than the trading opportunities since the online broker allows opening deals for a more significant amount. This is the number of funds that can be borrowed from the broker to open a position. Given what does Forex leverage mean, you can calculate leverage yourself using a formula based on margin. To do this, you need to divide the total cost of the transaction by the required margin:

Margin-Based Leverage = Total Transaction Cost / Required Margin.

Thus, by understanding the basics of what's leverage in Forex trading, a trader gets a chance to increase profits from successful trading. On the other hand, it also increases the risk of losses, as even small price changes can lead to significant losses.

Forex trading with leverage

One of the main features of Forex leverage is its high value. Typically, brokers offer leverage from 1:50 to 1:500, which means that for every dollar invested, a trader can control a market position of 50-500 times its value. This allows traders to make much larger trades than if they were working with their funds. This is how does leverage work Forex.

Another feature of Forex leverage is that it is available to almost any trader. No one requires a large initial deposit from the investor, which allows trading even with a small starting capital.

How does leverage work in Forex?

How to use leverage in Forex successfully? You do not have the option to trade completely without risk, but the rules of trading with Forex trade leverage are the same as in any other circumstances. That is, a trader must adhere to their strategy, as well as pay attention to signals and indicators and the results of technical and fundamental analysis. It is also important to navigate economic events that impact the value of shares and fluctuations in the price of currency pairs.

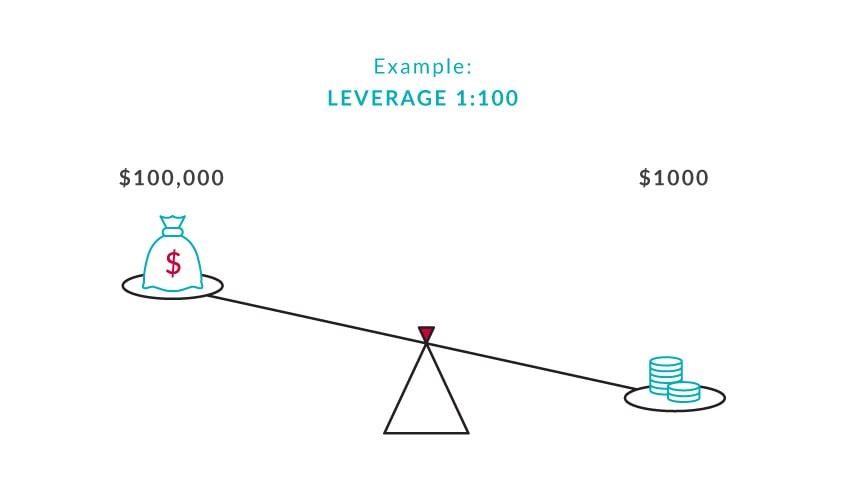

So, leverage for Forex works according to the same rule described in the definition of leverage in Forex: a trader can control a much larger position than their initial deposit. For example, if a broker offers a leverage of 1:100, this means that for every dollar deposited by a trader, they can control a position of $100.

There is one good example: if a trader has $1,000 in their account and uses a leverage of 1:100, they can open a position of $100,000.

Leverage ratio in Forex

The leverage ratio in Forex is the ratio between the total value of the position the trader opens on the market and the necessary margin for the execution of this transaction. For example, suppose a trader opens a position of $10,000 with a margin of $1,000. In that case, the leverage ratio is 10:1. In other words, the broker gives the trader $10 of credit for every dollar of margin they have deposited.

Forex leverage can vary significantly from broker to broker and depend on many factors, including regulatory requirements, the size of the broker, and its riskiness. Therefore, before opening an account and starting Forex trading, you should carefully study the broker's leverage policy and understand how it can affect your trading positions.

Leverage in Forex: Example

We have already considered several examples above. Typically, this leverage in Forex example is used for easy calculation and understanding of the essence of this concept.

The trader plans to open a position on EUR/USD. The broker offers a leverage of 1:100, which means that for every $1,000 in a trader's account, they can make a $100,000 deal. If a trader opens a position for 1 lot (100,000 currency units), they need to make a margin of 1% of the total value of the transaction, i.e. $1,000. If the transaction is profitable, then from the moment of its closure, the trader will receive earnings that will be higher than if they traded without using leverage.

But to explain how to use leverage in Forex, here is another example:

The trader has $10,000 in their account. The broker offers a leverage of 1:50. A trader opens a position on GBP/USD for 1 lot, with a total value of $100,000. To open such a trade, the trader must deposit a margin of 2% of the total value of the trade, i.e. $2,000. If the deal is profitable, then from the moment of closing, the trader will receive earnings that will be higher than if they traded without using leverage.

How to calculate leverage in Forex

Calculating leverage in Forex may seem difficult at first. Here is a short step-by-step guide to help you calculate leverage for Forex whenever needed.

- Find the margin value that your broker sets. Margin is a cash deposit in your account to trade Forex. It is usually a percentage of the total value of the position.

- Determine how much money you want to invest in a certain position.

- Divide the total value of the position by the margin value to get the leverage ratio. For example, if the total value of the position is $10,000, and the margin is 2%, the leverage will be equal to 50 (100 / 2).

This is how Forex trading with leverage gives you more opportunities. Use them competently and carefully to get a good profit.

Pros & cons of Forex trading with leverage

One of the main benefits of leveraged Forex trading is the potential for higher returns. By using leverage, traders can control larger positions with less capital, which can increase profits if the trade goes in their favor. However, leverage trading means diversifying a portfolio without investing a large amount of capital. Thanks to this trick, traders can open several positions with a smaller amount of money, which provides more flexibility in their trading strategy.

The phenomenon of leverage is closely related to the high liquidity of the Forex market. Everything is straightforward. Traders can easily enter and exit positions due to the high trading volume and 24/7 nature of the market, which can lead to lower transaction costs and better pricing.

However, leverage gives traders more opportunities to profit by taking advantage of small price movements in currency pairs. With the ability to control larger positions, even small changes in exchange rates can lead to significant profits.

You have found a high-leverage Forex broker. Can anything go wrong?

It is crucial to understand the risks in advance and not to perceive credit funds as the best good. Experienced traders call it a double-edged sword, and they did not coin such a term by chance. This phenomenon can be your best friend or put you at the financial bottom. At the same time, you can never 100% know how everything will turn out in advance because, despite numerous indicators, forecasts, and strategies, there are force majeure factors.

So what exactly should you be wary of?

- Higher risk. You can increase not only profits but also losses. Sometimes, financial losses are even greater than the initial investment.

- When trading with leverage, traders must maintain a minimum margin level. If the position moves against the trader and the margin level falls below the required amount, a margin call can be made, forcing the trader to deposit additional funds, or the trader risks having their position automatically closed.

- When using leverage, traders often have limited control over their trades because the market can move quickly and unexpectedly, resulting in losses that exceed the initial investment.

- Trading with leverage can also increase psychological pressure and stress, as traders may feel more pressure to make quick profits and take larger positions than without leverage.

- The trader faces more transaction costs because they have to pay interest on borrowed funds. This reduces the real profit and the deal's overall effectiveness.

The Bottom Line

It's important for you to have leverage working in your favor to help you land high-volume deals. It gives more profit. But even the best professionals have failed deals. And a great tool becomes a sentence because not only the deposit amount is lost but also additional funds.

Therefore, before using leverage on Forex, it is necessary to study all its features and risks to ensure safety and minimize losses. You should also consider your experience level and financial capabilities before using leverage. So, summarizing everything said above, we come to the conclusion that it is worth using credit funds only when you are sure that you have all the following:

- You understand the risks and are both morally and financially prepared for possible losses. Never open trades for amounts you will not be able to cover in a short time in case of failure. That is, when opening a position, you should hope for success but do everything so that in case of failure, it does not become fatal for your activity.

- You have strong analytical skills. A trader must have technical and fundamental market analysis expertise to make informed decisions.

- You can confidently say that you follow financial discipline. A trader must have a trading strategy that they follow and be able to control their emotions to avoid making emotional decisions. Also, a trader must be patient and consistent in their decisions.

- Do not rush to use large trading leverage until you have gained sufficient experience in financial management. An investor must have experience in managing funds and know how to allocate risks and set a stop loss.

So, you need serious knowledge and skills trained in automatism to move into leveraged trading. Don't be tempted by potential profits alone. Be aware of potential losses. This allows you to make informed and disciplined decisions.