- Interest rate risk is associated with sudden changes in interest rates that can impact market instability. Changes in interest rates affect currency prices as they influence the cost and investment levels in the economy based on the direction of the exchange rate change.

- Liquidity risk pertains to the potential of experiencing financial setbacks as a result of the incapability to promptly purchase or sell an asset. While the foreign exchange market typically exhibits substantial liquidity, there may be occurrences of diminished liquidity contingent upon the specific currency involved and the governmental regulations pertaining to foreign currencies.

- When trading on margin, there is a risk of suffering large losses, known as leverage risk. Since the initial investments are smaller than the value of Forex trades, it is essential to assess the amount of risk capital before engaging in leverage trading.

How to manage risk in Forex trading

Proper risk management in Forex means that you consider all these factors in your activity and know how to act in various situations, or the system automatically triggers to prevent you from losing all potential profit or assets at once. You can utilize different strategies to minimize potential losses. Also, in the early stages of your trading career, it makes sense to use the best Forex robots to relieve you of operational burden and allow you to focus on fundamental aspects and not miss anything crucial.

Setting Risk Tolerance and Establishing Risk-Reward Ratios

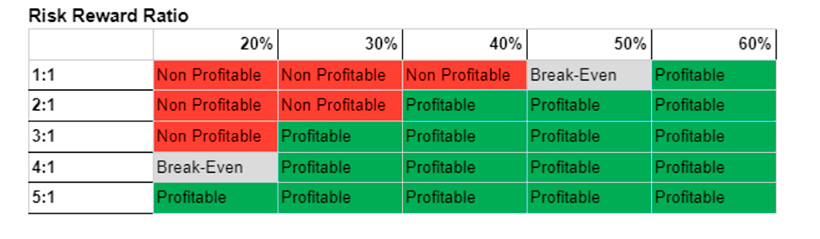

Defining an acceptable level of risk and determining a risk-reward ratio is crucial when engaging in Forex trading. Efficient money management encompasses establishing the maximum permissible loss a trader is willing to incur within a single trade, which is contingent upon their financial capacity, risk tolerance, and trading approach. By establishing a suitable risk threshold, traders can mitigate potential losses and safeguard their invested capital. The risk-reward ratio determines how profitable a potential trade is compared to the risk it carries. This type of Forex risk management strategies is measured in the ratio between potential profits and potential losses. Typically, traders seek trades with a favorable risk-reward ratio, providing greater rewards than losses.

Setting an acceptable risk and establishing a risk-reward ratio helps traders control their losses and increase potential profits. It is essential to conduct risk analysis before each trade, determine entry and exit points in the market, and use protective orders such as stop-loss orders.Any trading on Forex is associated with certain risks. If you still think you can easily and quickly make money here without putting in effort and understanding the basics of Forex risk management, it can work against you.

Traders encounter daily risks, as anything can easily get out of control. The fast pace of transactions, the immediate satisfaction of making a profit in under a minute, and the adrenaline rush may trigger a gambling instinct that some traders might give in to. This can lead them to view online trading as a game of chance. However, trading is not a gambling game, and the main difference lies in the fact that professional traders achieve success, in part, by responsibly approaching FX risk management.

Understanding Forex Risk Management

What is risk management in Forex? In essence, it refers to a collection of guidelines, resources, and tactics that reduce the adverse effects of unforeseen factors. In other words, it's the safety measures a trader can employ to avoid losing everything on a few unsuccessful trades (unfortunately, that can happen too). In risk management in Forex trading, it's crucial to have a well-planned strategy from the beginning because starting to trade and then attempting to manage risks is like giving matches to a child and then trying to extinguish a fire.

What are the risks of Forex trading?

- When buying or selling currency, the prices can fluctuate, which poses a risk. This risk is higher when working in international currency markets, but it can also have an indirect impact on you through stocks and commodities.

Position Sizing and Leverage Management

Among the risk management strategies in Forex trading, one of the key ones is determining position size and managing leverage. Let's take a closer look at these factors that will help you stay afloat under any circumstances:

- Position size determines the appropriate amount of capital to allocate to each trade. When trading, it's important to take into account your risk tolerance, account size, and risk-reward profile. By calculating your position sizes with care, you can efficiently manage your overall risk and prevent significant losses.

- Effective leverage management revolves around the utilization of leverage in trading. Traders have the ability to employ leverage to manipulate larger market positions while utilizing minimal capital, enabling the potential for amplified profits while also exposing themselves to heightened risks of substantial losses. Therefore, exercising caution and implementing effective Forex risk management strategies when using leverage is essential. We have already reminded you about common mistakes beginner traders make, so take this information into account.

By implementing effective methods for determining position size and leverage, traders can improve their risk management practices, protect their capital, and increase their chances of long-term success in trading.

Utilizing Stop-Loss and Take-Profit Orders

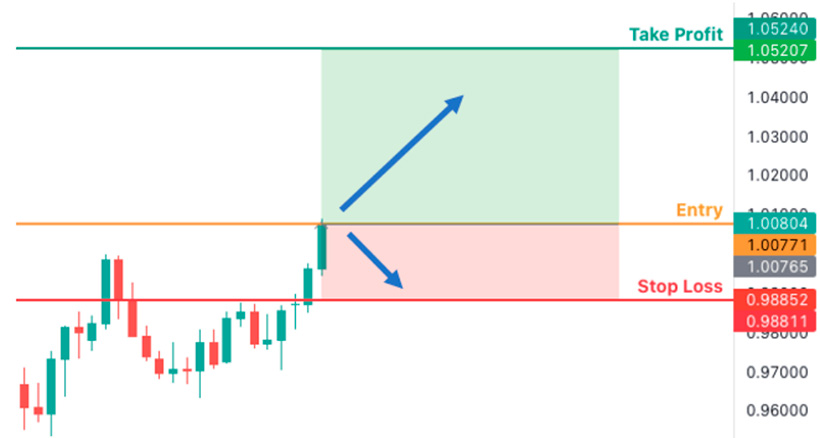

The use of Stop-Loss and Take-Profit orders is an essential strategy for successful trading in financial markets. These orders allow traders to automatically protect their positions in case of adverse price movements or secure profits when a certain level is reached.

- A Stop-Loss order is placed below the current asset price and is triggered if the price falls to the set level. It allows the trader to limit losses and automatically close the position before the losses become unacceptable. The Stop-Loss order helps reduce emotional stress and the risk of significant losses since the trader can determine the maximum amount they are willing to lose in a given position.

- On the other hand, a Take-Profit order is placed above the current asset price and is triggered when the price reaches the set level. It allows the trader to secure profits and automatically close the position when achieving the target level. The Take-Profit order helps the trader preserve the earned profit and eliminates emotional instability that may lead to prematurely closing a position with insufficient profit.

To determine appropriate levels, traders should consider their risk profile, analyze the market, and evaluate their trading strategies. Learn about profitable strategies that are currently working best here.

Diversification and Hedging Strategies

Diversification and hedging strategies are also Forex risk management tools. Diversification involves spreading investments across different financial instruments, markets, or sectors, which helps reduce dependence on individual assets since gains on others can offset potential losses on one asset.

Meanwhile, hedging involves opening opposing positions to mitigate risk. For example, a trader anticipating a decline in the value of a currency may open a selling position while simultaneously entering a long position on another asset that can offset potential losses. Thus, hedging reduces the impact of adverse movements on the account and provides a more resilient market position.

Ongoing Monitoring and Adjustments

Market conditions can change rapidly, so active monitoring and readiness to adjust strategies can be crucial. Incorporate this into your best Forex risk management strategies, and you'll be able to respond promptly to market changes and make informed trading decisions.

It's important to track not everything indiscriminately but focus on current trends, news, and events that can impact currency exchange rates and other financial instruments. You can also analyze the outcomes of previous trades to identify the reasons for mistakes and determine effective ways to avoid them.

The Bottom Line

Risk management in the Forex market is a critically important aspect for traders. Regardless of experience or capital size, risks are always present in trading. However, implementing risk mitigation strategies can significantly reduce the probability of financial losses and ensure a more stable trading activity.