Among numerous FX indicators, the Average True Range stands out. Its primary goal is to measure the instability of an asset’s price. It doesn't actually say anything about the vector of the trend but simply shows the level of fluctuations. The metric is used in trend strategies to assess the probability of a trend reversal and determine the moment the price exits the flat. It also serves to set stop loss and take profit orders and is used to estimate the width of the interval when trading using channel strategies. If you have any questions, the ATR indicator is explained in this article.

What is ATR in Trading

The average true range definition was first given by W. Wilder in the groundbreaking book written in 1978. ATR is rarely used on its own, but it is great for checking whether the targets are positioned correctly.

This is an oscillator-type indicator that shows the “velocity” of price changes. Its main idea is that if the ATR value increases, then the asset is experiencing high trading activity and the current trend continues. If the ATR indicator value decreases, the market's attention to this asset decreases — the current trend weakens, and the probability of a reversal is high.

In the abbreviation, the Range refers to the distance between the high and low of one bar on any time frame (hourly, four-hour, daily, etc.). It is called True because gaps are taken into account. Forex trading is carried out almost around the clock, but there are also breaks during the weekend. Saturday and Sunday are the days when these gaps form. Gaps may also occur in some other cases, for example, when central bank interest rates are released, important news is published, etc.

How Average True Range Works

The volatility of a currency pair refers to the amplitude of the price movement, that is, the interval that it can travel over a certain period. By revealing the mean value of this metric, the trader will know about the potential of the selected asset and will be able to find a point in time to open a transaction or, conversely, exit it.

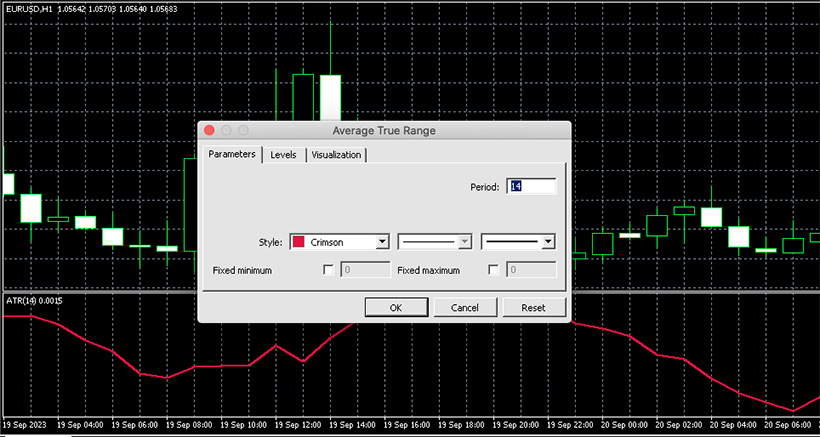

The ATR indicator is located in a separate box under the chart of the currency pair. It is represented by a curve that fluctuates up and down within a limited interval. The indicator values are calculated based on the closing price, as well as taking into account local extremes that the price showed over a certain period. The inventor of the indicator recommended taking the values of fourteen consecutive candles. The resulting points are smoothed to obtain a moving average, which is displayed on the indicator chart.

The index is so easy to use and calculate that it forms the basis of many other technical tools. It is often included in trading strategies and is used in all types of markets.

How to Calculate the ATR

The average true range calculation is based on 14 periods. Regardless of the duration of a period (hour, day, week, etc.), the formula remains the same. For example, a new value is calculated every day on a daily chart and every minute — on a minute chart. When you plot all the values on the diagram, the dots form a curve that demonstrates the change in volatility over time.

To find the average true range formula, you first need to calculate a series of true ranges (TR). The TR is calculated using the following formula:

TR = max(High(t) − Low(t), abs(High(t) − Close(t) − 1), abs(Low(t) − Close(t) − 1))

Where:

TR is the true range for period t,

High(t) — maximum price for period t,

Low(t) — minimum price for period t,

Close(t) − 1 — closing price of the previous period (t − 1),

max() - operation of selecting the maximum value,

abs() is an operation for obtaining an absolute value or modulus.

This formula can be reduced to the form:

TR = max(High(t), Close(t) − 1) − min(Low(t), Close(t) − 1)

Where:

min() is the operation of selecting the minimum value.

After calculating the TR values for needed periods, you can obtain the Forex average true range over a specified number of periods. Popular periods for calculating are 7 and 14.

The ATR formula for calculating average meaning is:

ATR = ((Prior_ATR x 13) + Current TR) / 14

How to Use Average True Range in Forex Trading

The graph allows you to see the moments when the price range begins to expand sharply. This property explains how to use ATR indicator and for what purposes:

- To build short-term strategies. A sharp surge in instability is an ideal moment for scalping.

- To make a decision on entering the market. If the marker has passed more than half of the average statistical range, most likely, it is too late to open a trade in the direction of the trend, and it is better to wait for a reversal.

- To determine profit goals. Take profit is set at or within the volatility range. For example, if the Average True Range indicator value is 60 points, it makes sense to set the take profit at the level of 45-50 points relative to the opening price of the transaction.

- To determine the stop-setting level. The stop loss is set outside the price fluctuations range. The coefficient by which ATR indicator Forex is adjusted is selected for each asset individually.

- To determine the moment of flat. If the value is low compared to the average volatility, the market is flat. This factor can be beneficial for certain strategies and tactics.

- To determine the end of a trend. The further the price line extends beyond the average true range, the more likely the tendency will end.

ATR Trading Advantages and Limitations

Average True Range is an important and quite popular metric. Traders and investors see numerous advantages in it. Among them are:

- Highly objective volatility measurement that takes into account all gaps. This helps traders make informed decisions regardless of their FX strategies and risk management.

- The indicator can be used as a basis for various purposes and ATR trading strategies. This makes it a highly versatile metric for people looking to enhance their working processes.

- Easy to use. ATR forex is a simple and straightforward metric that can be calculated using readily available charting software. Traders do not need to have a deep understanding of complex mathematical models or technical analysis techniques.

The benefits of using ATR make it a valuable tool for investors looking to manage risk, identify potential trading opportunities, and optimize their ATR strategy. However, we cannot fail to mention some drawbacks of the index:

- Since the index is based on past price movements, its value is limited by outdated data. As a result, the accuracy of predicting future price movements may be inaccurate.

- The metric does not provide information about other market factors affecting the asset. Traders should definitely use other technical tools and analysis methods in conjunction with ATR to make informed trading decisions.

- The interpretation of values may vary depending on the individual trading style and preferences of the trader. Thus, some trading experience is required to use it effectively.

- The Forex ATR indicator can be affected by sudden price changes and gaps. Factors such as these can skew the ATR reading and make it less reliable.

ATR Strategy Best Practices

Experienced traders advise using ATR in combination with other technical instruments. It is also important to make the correct settings. You can easily change them if you use MetaTrader 4 or most other popular trading programs.

Most often, ATR in Forex is set with a period of 14, which is the default value. Thanks to the metric, you can not only monitor volatility and make forecasts but also track divergence signals. So, if on the chart, the price forms new highs when the ATR line decreases (or lows and the line rises), most likely, there is a divergence in the market. That is, traders lose interest in the movement and are not confident in the continuation of the trend. But if the price creates new highs and the ATR demonstrates the same, it means that trading participants are confident in the continuation of the current tendency.

If you set the filtering, you can exclude all non-trend price fluctuations. In this case, trades are opened in the direction of the asset's movement after the price has crossed the line in the middle of the range, which is calculated by adding two values (above and below) and then dividing the result in half. After the middle of the range is obtained, the resulting numerical value is written in the ATR indicator window and added to the window.

Conclusion

The volatility indicator is necessary for professional trading. For novice traders, it may not make much sense, especially compared to other tools. However, knowledge about it will be useful when developing an ATR trading strategy.

While ATR definitely has some minor disadvantages, such as being tied to past data and requiring a human interpretation, its benefits make it a versatile tool for traders looking to manage risk and make better decisions. After all, the number of advantages is notably bigger.

Traders should remember that ATR Forex is just one tool among hundreds of others. Many of them you can explore with the best Forex robots. You should definitely not make trading decisions based on one instrument. However, by using combinations of various technical analysis tools, traders will be able to better comprehend market conditions and ultimately maximize their profits.