Sie müssen die Struktur des Devisenhandels im Allgemeinen lernen, um zu verstehen, was Spreads im Devisenhandel sind. Der erste Punkt ist, dass alle Devisentransaktionen über Vermittler abgewickelt werden. Diese Vermittler (Broker) arbeiten nicht kostenlos. Die Bezahlung für ihre Dienstleistungen ist in den Kosten jeder Transaktion enthalten. Der Gewinn eines Online-Brokers ergibt sich aus dem Unterschied zwischen dem Angebots- und dem Nachfragepreis. Wenn Sie also versuchen zu verstehen, was Spreads im Devisenhandel bedeuten, hier ist die Antwort.

Werfen wir einen genaueren Blick auf die Natur und die Merkmale des Spreads im Devisenhandel. Gleichzeitig werden Sie die Regeln zur Berechnung der Spreads, die Geheimnisse der Verwaltung dieses Werts und Handelsstrategien, die darauf basieren, kennenlernen.

Was ist der Spread im Handel?

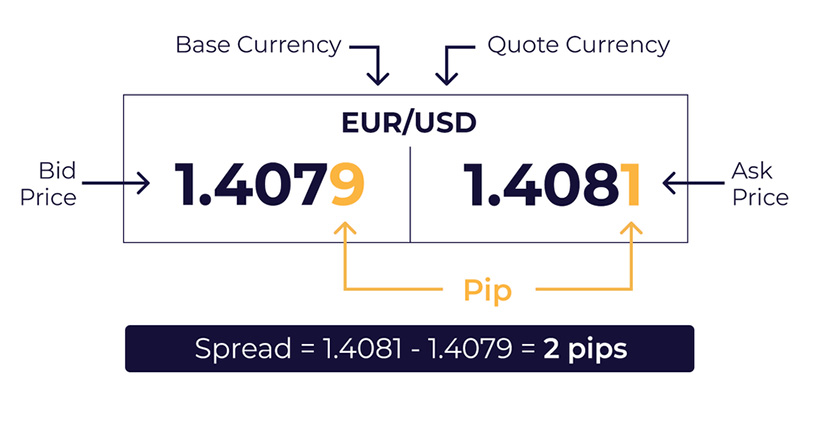

Also, die Differenz zwischen dem Angebots- und dem Nachfragepreis ist die Antwort auf die Frage, was Spreads im Devisenhandel sind. Die vollständige Definition des Forex-Spreads sieht so aus:

Die Bedeutung des Spreads im Devisenhandel wird als der Betrag erklärt, den ein Händler an einen Online-Broker für die Durchführung einer Handelstransaktion zahlt. Auch sieht die Bedeutung des Spreads im Devisenhandel wie der Unterschied zwischen den Kauf- und Verkaufspreisen eines Handelspaars aus. Gleichzeitig ist der Kaufpreis immer höher als der Verkaufspreis, während der Marktpreis der Basiswährung ungefähr in der Mitte zwischen diesen Werten liegt.

Die Größe des Spreads hängt von der Stabilität des Währungspaares, seiner Liquidität, den Volumina und der Handelszeit ab. Sie hängt auch vom spezifischen Broker ab, dessen Dienste der Händler nutzt.

Arten von Spreads im Devisenhandel

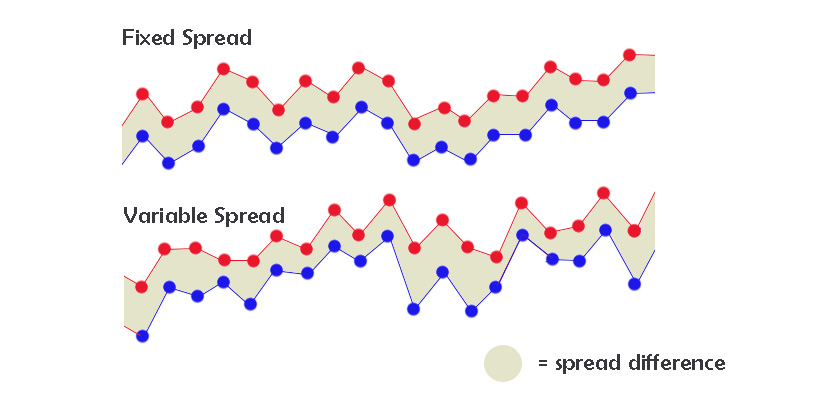

Forex-Spreads gibt es in zwei Arten: fest oder variabel. Wenn es um den Handel mit Währungspaaren geht, handelt es sich um einen variablen Spread, da der Geldkurs und der Briefkurs ständig schwanken. Nachrichten, Ereignisse und andere Faktoren verursachen Volatilität. Dies ist nicht immer bequem, da es ein Risiko für eine scharfe Ausdehnung und ein Abrutschen des Spreads gibt. Gleichzeitig hat diese Option ihre Vorteile: Erfahrene Händler können damit arbeiten, da es durchaus möglich ist, einen engen Spread zu erzielen, anstatt eine Re-Notierung zu erhalten.

Die feste Option erfordert geringere Kapitalanforderungen, bietet stabile und vorhersehbare Transaktionskosten und ist von Marktschwankungen unbeeinflusst. Auf Forex können Sie jedoch einen Broker mit niedrigem Spread finden und sparen.

Wie berechnet man den Spread im Forex?

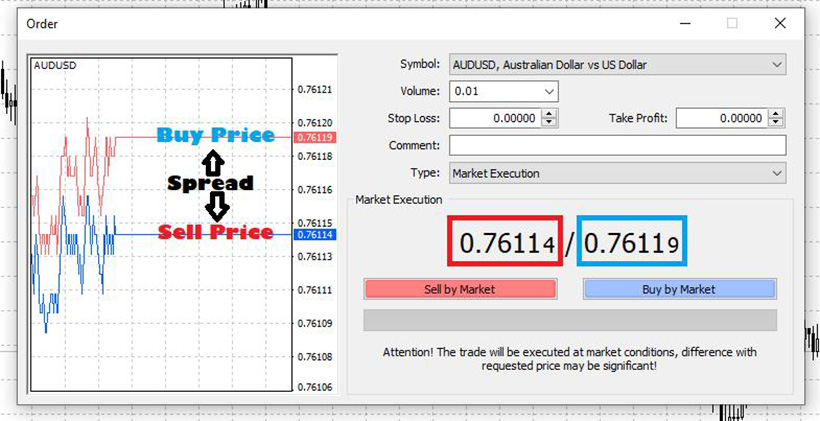

Um herauszufinden, was ein guter Spread im Forex ist, müssen Sie lernen, wie man den Spread berechnet. Der Spread ist eine variable, instabile Größe, selbst für dasselbe Währungspaar. Der Forex-Spreadkosten werden wie folgt definiert: Der Verkaufspreis wird vom Kaufpreis abgezogen.

Zum Beispiel, beim Handel mit dem GBP/USD-Paar bei 1.3085/1.3087 beträgt der Spread 1.3087-1.3085=0.0002.

Das heißt, der Spread beträgt in diesem Fall 2 Punkte.

Je mehr Punkte Sie im Berechnungsprozess erhalten, desto breiter (oder höher) ist der Spread, und umgekehrt. Die Aufgabe des Traders besteht darin, enge Spreads zu finden, da sie bei solchen Operationen weniger verlieren und der Handel in diesem Fall zugänglicher ist. Mit zunehmender Handelserfahrung müssen Sie nicht mehr daran denken, wie man den Spread im Forex berechnet - es geschieht automatisch. Sie können sich auch auf die besten Forex-Roboter verlassen, um mit verschiedenen Handelsproblemen umzugehen.

Hinweis! Der Spread scheint nur gering zu sein. Im Kontext großer Handelsvolumina handelt es sich um signifikante Beträge: ab $10 für ein Standardlot.

Wie können Sie den Spread in Ihrem Handel verwalten?

Der Trader hat die Möglichkeit, die Kosten für Spreads zu minimieren. Dies wird durch die Definition selbst gerechtfertigt, was bedeutet Spread im Forex? Es gibt mehrere Hauptwege, um dieses Ziel zu erreichen:

- Handeln Sie zur günstigsten Zeit.

- Vermeiden Sie Währungspaare mit geringer Liquidität.

- Nutzen Sie die Dienste von Brokern mit niedrigen Spreads.

Ein günstiger Zeitraum für den Handel gilt als die Zeit, in der Wettbewerb und Nachfrage nach einem bestimmten Währungspaar steigen. Zu diesem Zeitpunkt verengen Market Maker die Spreads, um die gewünschten Positionen zu erfassen. Eine dünn gehandelte Währung hat eine geringe Nachfrage und entsprechend weite Spreads. Der Höhepunkt der Liquidität wird zwischen 13:00 und 17:00 Uhr Londoner Zeit beobachtet. Der Handel vor oder unmittelbar nach der Veröffentlichung wichtiger Nachrichten ist jedoch äußerst ungünstig. Es besteht die Tendenz, dass die Spreads zu solchen Zeiten steigen.

Sie können nicht ohne Broker Forex handeln. Sie haben jedoch immer die Möglichkeit, den Broker auszuwählen, der günstige Bedingungen bietet. Normalerweise sinken mit steigender Einzahlung des Investors die Transaktionskosten.

Was bestimmt die Veränderung des Spreads im Forex?

Die Hauptgründe für die Schwankung des Spreads sind die folgenden Faktoren:

- Marktinstabilität;

- Eine Veränderung der wichtigsten wirtschaftlichen Indikatoren, die ein bestimmtes Währungspaar stärken oder schwächen;

- Wenn ein Währungspaar weniger liquide wird, weitet sich der Spread aus;

- Bei großen Marktsitzungen verengt sich der Spread.

Trader prognostizieren die Möglichkeit eines breiteren oder engeren Spreads basierend auf diesen und anderen Faktoren.

Die gleichen Zeichen müssen erwähnt werden, wenn wir definieren, was im Kryptowährungshandel verbreitet ist. Im Falle von Kryptowährungen gelten die gleichen Regeln wie beim Handel mit anderen Währungspaaren. Insbesondere deutet ein niedriger Spread auf Liquidität hin, und ein Ungleichgewicht auf dem Vermögensmarkt führt zu einem weit verbreiteten Anstieg. Ein Mangel an Liquidität tritt auf, wenn nur wenige Personen handeln, oder er tritt unter dem Druck von Manipulation und guten oder schlechten Nachrichten auf. Daher gelten im Kryptowährungssektor die gleichen Regeln für die Berechnung des Spreads und die Gründe, die ihn beeinflussen.

Forex-Spread-Handelsstrategien

Was ist der beste Spread im Forex? Natürlich ist der Trader daran interessiert, eine niedrigere Gebühr zu zahlen, da die Einsparungen Teil des Gewinns sind. Das Verfolgen von Gelegenheiten mit niedrigem Spread ist eine Handelsstrategie. Der Trader sucht nach optimalen Ein- und Ausstiegspunkten und verfolgt die neuesten Nachrichten und andere makroökonomische Indikatoren. Diese Strategie wird als ereignisgesteuerter Handel bezeichnet.

Der Forex-Spread-Indikator ist eine weitere gute Strategie, um die Gelegenheit zu verfolgen, von einem niedrigen Spread zu profitieren. Der Indikator ist eine Kurve auf dem Chart, die die Spread-Richtung anzeigt.

Die dritte Option, die von Forex-Händlern verwendet wird, ist die Überwachung des Spreads und die ständige Kontrolle über das Konto. Diese Strategie hilft dabei, das Risiko eines Margin Calls oder einer Liquidation zu beseitigen oder zu minimieren. Ein Margin Call tritt auf, wenn der Wert des Kontos eines Traders über das 100%-Margin-Niveau fällt. Das Erreichen eines Niveaus von 50% unter dem Margin führt zur Möglichkeit der Liquidation aller Positionen.

Wie wählt man einen Broker mit niedrigem Spread aus?

Forex-Broker wissen am besten, was ein Forex-Spread ist, weil sie damit Geld verdienen. Einige Broker berechnen zusätzlich eine Provision von 1,5-4,5 USD pro Spread. Häufig stehen zusätzliche Provisionen für diejenigen Broker zur Verfügung, die auf den ersten Blick die günstigsten Bedingungen bieten. Daher ist es die Hauptaufgabe eines Traders, einen Broker mit günstigen Konditionen zu finden.

Trotzdem gibt es Broker mit niedrigen Spreads auf dem Markt. Ein Trader kann einige Tipps und Lifehacks verwenden, um sie zu finden. Alle Empfehlungen laufen darauf hinaus, dass eine Recherche durchgeführt werden muss. Die folgenden Kriterien sollten als Grundlage der Studie genommen werden:

- Analyse der Forex-Provisionen.

- Verfügbare Anzahl von Währungspaaren.

- Vorhandensein einer bewährten und zuverlässigen Regulierung der Brokeraktivität.

Wenn der Broker in allen Parametern zuverlässig erscheint und gleichzeitig günstige Bedingungen bietet, lohnt es sich, zur nächsten Forschungsphase überzugehen:

- Ein Demokonto eröffnen.

- Verfügbare Plattform-Tools testen.

- Auf Funktionalität und Benutzerfreundlichkeit achten.

Die dritte Stufe besteht darin, mit echtem Geld zu handeln und sicherzustellen, dass die vorherigen Schlussfolgerungen zutreffen.

Dieser Prozess dauert zwar seine Zeit, spart jedoch echtes Geld und Risiken und gibt Vertrauen in eine weitere Zusammenarbeit. Im Internet gibt es viele fertige Bewertungen von Plattformen und Websites sowie echte Bewertungen auf unabhängigen Webressourcen. Sie können diese Informationen weiter studieren, bevor Sie mit dem Handel beginnen. Einige Experten bieten auch Bewertungen an, in denen sie Broker mit niedrigen Spreads nach den oben genannten Kriterien einstufen. Vergleichen Sie ihre Ergebnisse mit Ihren eigenen, um eine endgültige Entscheidung zu treffen.

Das Fazit

Die Verbreitung des Forex-Begriffs ist der Unterschied zwischen den Kauf- und Verkaufspreisen eines Währungspaares und wird in Punkten oder Pips berechnet. Broker bieten ihre Dienstleistungen für Händler an und erhalten dafür eine Verbreitung als Gebühr. Investoren und Händler wiederum versuchen, Kosten zu kontrollieren. Dies führt sie dazu, nach profitablen Kooperationen zu suchen und Strategien zu entwickeln, die helfen, maximalen Gewinn bei minimalen Betriebskosten zu erzielen.