Der Handel ist ein spezifisches Gebiet menschlicher Aktivität. Um erfolgreich zu sein, müssen Sie über eine ziemlich große Menge an Wissen und Fähigkeiten verfügen, einschließlich der Fähigkeit, Handelsmuster zu analysieren. Eines der am häufigsten verwendeten Modelle ist die Shooting Star Candlestick. Schauen wir uns genauer an, welche Merkmale sie hat und welche Marktentwicklungen sie anzeigt.

Verständnis von Shooting Star Candlestick-Mustern

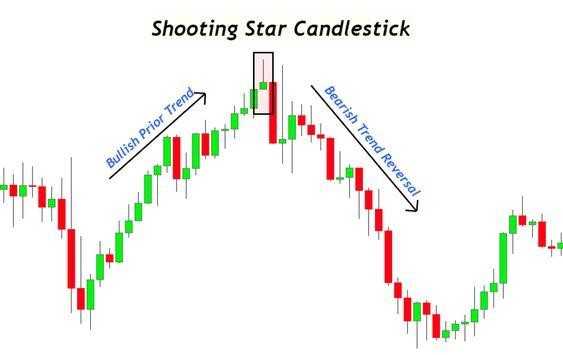

Die Shooting Star Candle ist ein Preis-Muster. Das Modell entsteht, wenn der Preis eines Vermögenswerts steigt und dann fällt. Folglich ist der Preis zum Zeitpunkt des Abschlusses gleich oder nahe dem zum Zeitpunkt der Eröffnung. Dieses Muster signalisiert einem Händler eine mögliche Marktwende und einen Übergang zu einem bärischen Trend.

Das Shooting Star Candlestick-Muster ist für Händler aufgrund der folgenden Vorteile praktisch:

- Einfache Erkennung;

- Einfache Analyse;

- Nützlichkeit bei der Erforschung von Markttrends.

Wie erkennt man Shooting Star-Muster?

Der Shooting Star Candlestick zeigt eine Situation auf dem Markt an, wenn der Preis eines Vermögenswerts nach der Eröffnung steigt, dann aber fällt. Folglich ist der Schlusskurs des Handels nahe dem Wert bei Eröffnung der Handelssitzung.

Das Shooting Star Chart Pattern erfüllt die folgenden Kriterien:

- Das Chart-Hoch ist signifikant höher als der Schlusskurs der vorherigen Kerze;

- Die Eröffnung der Kerze liegt nahe am Schlusskurs des vorherigen Charts;

- Das Muster schließt unter dem lokalen Hoch, das am Anfang des aktuellen Zeitraums gebildet wurde.

Anatomie eines Shooting Star Candlestick

Die Shooting Star Kerze sieht spezifisch aus. Sie hat einen kleinen Körper und einen langen oberen Schatten, was auf Kaufdruck und folglich auf einen Anstieg des Vermögenspreises hinweist. Dieser Teil des Diagramms sollte mindestens größer sein als die gesamte Länge des Kerzenkörpers.

Der untere Schatten des Diagramms ist kurz. Er deutet auf einen Preisrückgang hin. Manchmal werden die Schatten einer Shooting Star Kerze auch als Docht oder Schwanz bezeichnet. Einige Modelle haben keinen unteren Schwanz. Sie sind jedoch ziemlich selten.

Unterschiede zwischen dem Shooting Star und dem Inverted Hammer

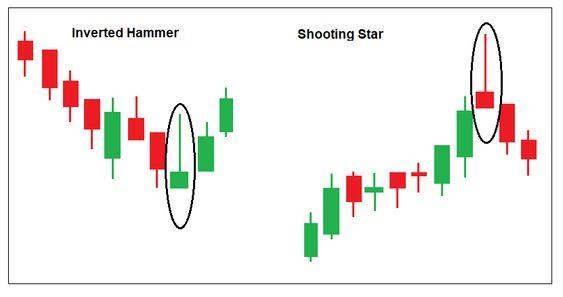

Händler verwenden viele Kerzenmuster. Einige von ihnen sind auf bestimmte Weise miteinander verbunden, wie zum Beispiel die Shooting Star Kerze und der Inverted Hammer. Bei der Analyse dieser beiden Handelsmuster ist es ratsam, auf den Kontext zu achten, in dem sie funktionieren. Das Shooting Star Kerzenmuster erscheint am Ende einer aufwärts gerichteten Preisbewegung. Es deutet auf den Beginn einer Trendumkehr zu einem Abwärtstrend hin. Was den Inverted Hammer betrifft, zeigt er den entgegengesetzten Trend. Das Muster entsteht, wenn der Schlusskurs höher ist als der Eröffnungskurs. Der Kaufdruck drückt ihn nach oben, was durch den langen Schatten angezeigt wird.

Validierung von Shooting Star Mustern: Zusätzliche Indikatoren und Signale

Erfahrene Händler wissen, dass Shooting Star Candlesticks den Beginn eines bärischen Trends auf dem Markt anzeigen und daher sollte damit gerechnet werden, dass die Preise zu sinken beginnen. Um jedoch sicher zu sein, dass das Urteil korrekt ist, lohnt es sich, zwei oder drei aufeinanderfolgende Candlestick-Muster zu analysieren, die nach dem Shooting Star erscheinen, und dabei nicht zu vergessen, andere Indikatoren zu verwenden.

Auch historische Daten werden für eine tiefere und genauere Analyse nützlich sein. Je mehr ein Händler davon verarbeiten kann, desto besser. Die besten Forex-Roboter werden jedoch in dieser Hinsicht am effektivsten sein. Ihr Vorteil bei der Datenanalyse im Vergleich zu Menschen ist offensichtlich. Diese Programme helfen dabei, die Marktsituation genauer zu untersuchen.

Interpretation der Shooting Star-Muster

Um die Bedeutung von Shooting Star Candlesticks zu verstehen, ist es wichtig, die folgenden Aspekte zu berücksichtigen.

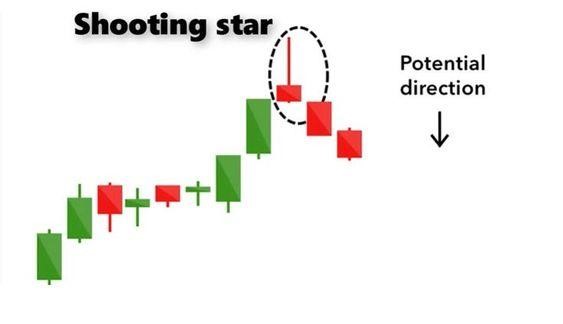

- Achten Sie auf den Preisanstieg nach der Markteröffnung. Dies deutet auf den Kaufdruck hin, der während der vorherigen Wachstumsphase bestand. Je größer die Anzahl der Käufer, desto länger ist die Docht der Kerze.

- Nach der ersten Phase sollte ein Preisrückgang erwartet werden. Dies erfolgt normalerweise am Nachmittag und erreicht ein Niveau nahe dem Eröffnungspreis. Solche Veränderungen werden durch eine Zunahme der Anzahl der Verkäufer verursacht. Sie drücken den Vermögenspreis auf das Niveau, das zum Zeitpunkt der Eröffnung des Handels bestand.

- Anschließend müssen die Investoren zur bestmöglichen Analyse die Trendumkehr bestätigen. Zu diesem Zweck analysieren Händler oft Candlestick-Muster, die auf den Shooting Star folgen. Ein Trend gilt nur als bärisch, wenn das Muster, das auf das oben beschriebene folgt, ebenfalls einen Preisrückgang widerspiegelt.

Die Shooting Star bestätigt einen Preisverfall, insbesondere wenn das Diagramm, das diesem Muster folgt, den gleichen Trend anzeigt. Händler betrachten solche Optionen wie Leerverkäufe oder Verkäufe. Somit hilft das Shooting Star Candlestick-Muster dabei, zukünftige Markttrends genauer vorherzusagen und entsprechend die richtigen Entscheidungen zu treffen.

Was zeigt uns der Shooting Star?

Das Shooting Star Candle-Muster besteht aus mehreren Teilen, wobei der breiteste den Unterschied zwischen dem Preis zeigt. Die obere Docht zeigt, wie der Preis vom Eröffnungskurs bis zum Tageshoch gestiegen ist. Die untere Docht ist oft kürzer und zeigt den Preisverfall bis zum Handelsschluss.

Um zu verstehen, was ein Shooting Star Candlestick ist, ist es auch wichtig, auf die Farbe des Diagramms zu achten, die den Unterschied zwischen dem Eröffnungs- und Schlusskurs anzeigt. Es gibt zwei mögliche Farben: grün und rot. Die erste Option zeigt, dass der Schlusskurs höher ist als der Eröffnungskurs. Der grüne Shooting Star Candlestick bedeutet einen bärischen Trend auf dem Markt. Andererseits ist der rote Shooting Star Candlestick ein stärkeres Signal, das den Händlern Informationen über den bevorstehenden bärischen Trend gibt.

Erkenntnisse aus den Shooting Star-Mustern

Laut dem Shooting Star Candle-Muster erkennt ein Händler, dass ein bärischer Trend auf dem Markt bevorsteht. Es ist jedoch zu früh, um Schlüsse zu ziehen, bevor am nächsten Tag ein neues Muster erscheint. Wenn auch andere Arten von Shooting Star Candlesticks einen Preisverfall anzeigen, können Investoren auf der Grundlage dieser Daten mit dem Treffen von Handelsentscheidungen beginnen, beispielsweise auf Leerverkäufe, den Verkauf von Vermögenswerten usw., zurückgreifen.

Händler sollten auf den aktiven Trend bei der Eröffnung des Musters sowie auf den Preisrückgang achten, der am Nachmittag auftritt. Der Trend muss bestätigt werden. Zu diesem Zweck verwenden Investoren Kerzenmuster für die nächsten Tage.

Einschränkungen des Shooting Star

Das Forex Shooting Star-Muster ist für Händler recht nützlich, hat aber auch seine Nachteile. Manchmal generiert dieses Modell falsche Signale. Deshalb ist es bei der Erstellung einer Handelsstrategie besser, mehrere ähnliche Diagramme zu verwenden (zum Beispiel wird das Shooting Star Doji Candlestick effektiv sein) und die Bedeutung der fundamentalen Analyse zu beachten. Auf diese Weise können Händler genauere Prognosen erstellen und mehr Gewinn erzielen.

Wie man Forex mit Shooting Star handelt: Tipps und bewährte Verfahren

Investoren verwenden den Shooting Star im Forex-Handel, um bärische Trends vorherzusagen und technische Analysen durchzuführen. Eine Übernahme des Marktes durch Verkäufer geht mit einem Preisrückgang einher, der zwangsläufig im Diagramm reproduziert wird. Um unter solchen Bedingungen erfolgreich zu handeln, sollte sich ein Investor auf die folgenden Maßnahmen konzentrieren:

- Suche nach einem Einstiegspunkt;

- Bestimmung des Zielgewinns;

- Aktive Nutzung von Stop-Loss.

Zusammenfassung

Der Shooting Star wird durch das Verhalten der Bullen am Markt gebildet. Bei Eröffnung der Sitzung waren sie aktiv, was zu einem Preisanstieg führte. Am Ende des Handelstages übernahmen jedoch die Bären die Initiative. Als Ergebnis fiel der Preis des Vermögenswerts auf das vorherige Niveau. Der Shooting Star im Forex-Handel deutet darauf hin, dass das Interesse der Bullen an einem Vermögenswert nachgelassen hat und die Händler eine Änderung der Marktsentimente und eine Trendumkehr erwarten sollten.

Die Wirksamkeit des Musters hängt davon ab, wie ein Händler mit diesem Chart arbeitet. Je besser sie diese analysieren können, desto erfolgreicher kann eine Anlagestrategie sein. Dazu lohnt es sich, mindestens zwei oder drei Kerzenmuster zu studieren, die der Bildung des Shooting Star folgen.