The Forex market is a place where both novices and professionals converge, where success stories and failures coexist. What draws people to this market is the multitude of sellers and buyers, all with equal opportunities for conducting technical and fundamental analysis, accessing highly liquid currencies, and executing the best deals available. Moreover, everyone can work independently and utilize the best Forex robots, which automate routine processes, leaving traders to focus on improving their strategies, optimizing them, learning, and making final decisions.

Centralized vs. Decentralized: The Forex Market Landscape

Before diving into trading, it's crucial to familiarize yourself with the environment you'll be working in. Just as a newcomer to a company first determines the number of floors in the office building and the location of each office, newcomers here need an understanding of what is Forex market structure. This allows for a better understanding of the factors influencing prices and trends, what to watch out for, and what to look for. Essentially, the market structure Forex serves as your compass, enabling you to comprehend the nature and functioning of this market.

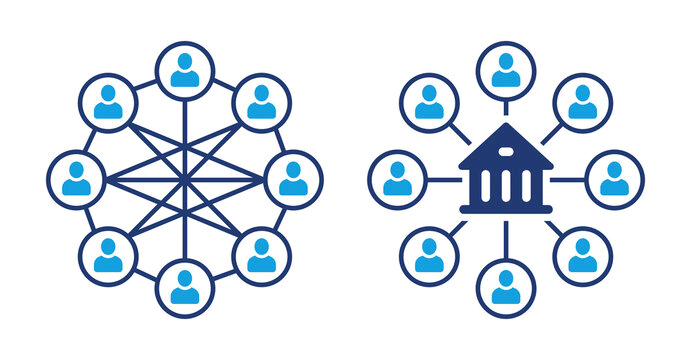

The centralized market is a system where all trading operations go through a single exchange point, from major to minor. This point can be a bank or another financial institution. In a centralized system, the main spheres of influence belong to financial cities like London, New York, and Tokyo. They are the ones that open and close trading sessions.

Unlike the centralized market, the decentralized market does not have a single exchange point, and trading takes place directly between market participants: banks, corporations, and private traders. Transactions are carried out through interbank systems or within electronic communication networks (ECNs). Unlike the centralized market, this one is more accessible to a wide range of users and often offers better prices. However, there is another difference: less transparency in deals.

So, where does Forex belong? To centralized or decentralized systems?

In fact, Forex combines elements of both systems, offering users a mix of the advantages of both options. This makes it flexible, dynamic, and transparent but not as limited as a classical centralized system. This is what attracts users worldwide.

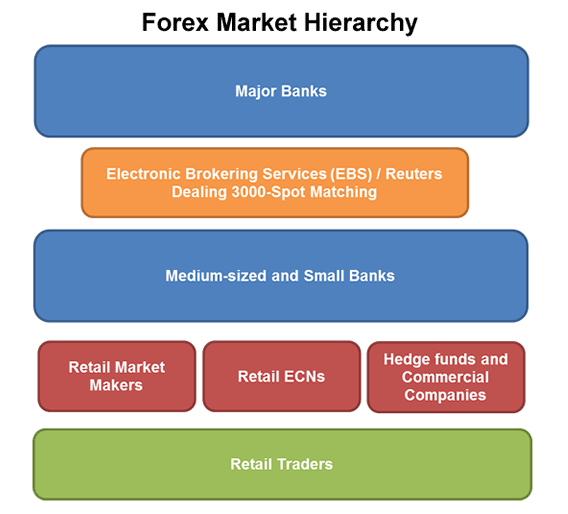

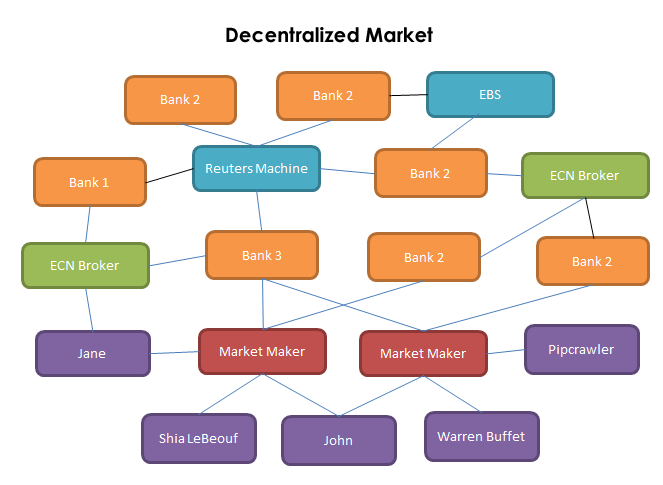

Components of Decentralized Forex Market Structure

Due to its characteristics, the FX market structure is largely decentralized. Centralized authorities do not control the Forex market, so the price of a currency pair can be influenced by all market participants, and as a result, there is no stable and uniform price set for a specific date. Quotes differ among various dealers, and during trading, you can choose the best option by comparing your request with the available offers provided in the liquidity pool. Although this may seem chaotic, such pricing is actually competitive, with prices influenced by both large banks at the top of the hierarchy and private traders.

The Interbank Market

The interbank market allows trading with large volumes in Forex. Various major banks participate in this process, either trading among themselves or utilizing platforms like EBS (Electronic Brokering Services) and Reuters Matching. They compete with each other, occupying the highest position in the market structure Forex seeking the best rates. The more parties are involved in this process, the higher the liquidity of the currency pair and the better the rates. However, access to these deals is only available to institutions with the appropriate creditworthiness and reputation, so despite the market not being centrally regulated, trading adheres to fairly strict and immutable criteria.

The Institutional Market

The institutional market includes ECN brokers, financial institutions, hedge funds, and so on. While these organizations have slightly less influence on the market than banks, they serve as the bridge between banks and retail traders. The rates here are better than for retail traders but not as advantageous as those used by banks.

Retail Market

The retail market is the lowest tier in the Forex market structure. It consists of all traders who have gained access to currency markets using the advantages of electronic trading. The rates here are the least favorable compared to the two higher tiers of the structure. However, there are still excellent trading opportunities, especially considering that reputable brokers strive to offer the best conditions in the competition for clients. Thus, even retail trading can be a promising option, which independent traders can take advantage of without being part of any financial organizations.

Trading Spot FX: Exploring the Decentralized Framework

When discussing the FX market structure, it's essential to explain what spot FX is, as it's crucial in understanding the market as a whole. Spot FX is trading "on the spot," meaning buying and selling a currency pair at the current rate. Forex trading allows you to operate your assets without taking ownership of them. This means that opening and closing each position will cost less, with smaller spreads. Therefore, if you adhere to a short-term strategy, you have a certain advantage due to this and can even practice scalping, which, under other conditions, would yield minimal profit.

Another feature of currency spot trading is that you always trade a currency pair: selling one (base) and buying another (quote). Thus, you profit from the assumption that the price of one currency relative to another will change. In that case, if your forecast is correct, you receive the corresponding profit. Keep in mind that spot trading is advantageous precisely in the context of short-term decisions. If you leave a position open after the market closes, brokers may charge an overnight fee. Consider these features and risks for profit generation and effective risk management.

The Bottom Line

Understanding how the Forex market structure is organized is crucial so that you can comprehend how prices are formed, who influences them, and which news to monitor to avoid mishaps. Understanding the structure and peculiarities of the Forex market helps effectively manage risks, conduct precise fundamental analysis, and closely monitor the best opportunities that arise. It's also why you should carefully consider the terms of different brokers when collaborating with one of them (otherwise, retail Forex trading is not possible).