Da das W-Bodenmuster eines ist, das so viele Händler bevorzugen, wollen wir uns mit diesem Thema befassen. Was bedeutet doppelter Boden im Devisenhandel? Wie können Sie dieses Modell für Profit nutzen und welche Tipps können Sie verwenden?

Beginnen wir damit zu sagen, dass dieses Muster nach einem langen Abwärtstrend auftritt und als Mittel zur Identifizierung von Kaufgelegenheiten dienen kann, wenn der Markt sich nach oben bewegt. Das doppelte Bodenmuster erhält seinen Namen von den zwei Böden, die sich auf einem bedeutenden Unterstützungsniveau bilden. Dieses Muster ist klar, weil es auf ein Marktniveau hinweist, an dem die Nachfrage das Angebot nicht nur einmal, sondern zweimal in einem relativ kurzen Zeitraum übersteigt.

Doppelter Boden: Was ist das?

Ein doppelter Boden ist ein technisches Chartmuster, bei dem zwei Tiefs auf einem ähnlichen horizontalen Preisniveau gebildet werden, was auf ein mögliches bullisches Umkehrsignal hinweist. Der Preis zeigt in der Regel Unterstützung auf den Tiefs, was zu einer gemessenen Konsolidierung zwischen den beiden tiefsten Punkten führt.

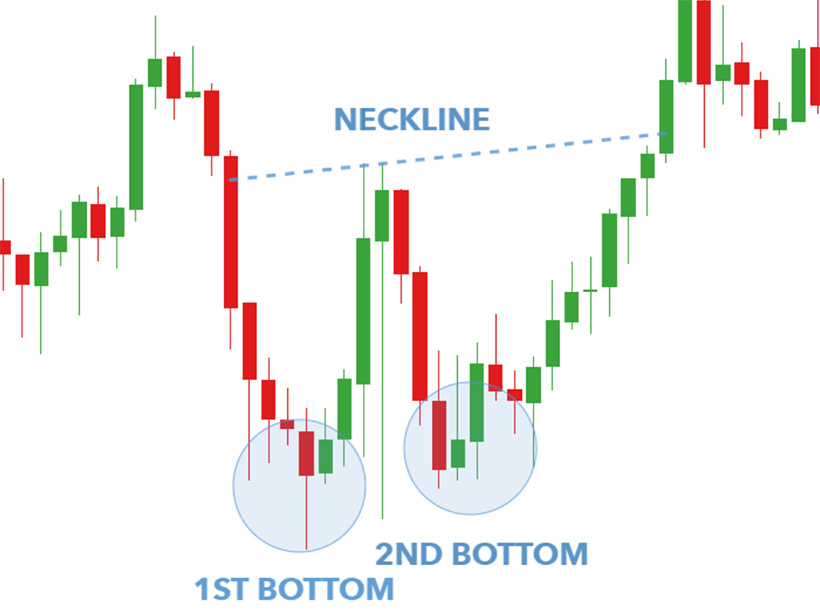

Dieses Muster wird normalerweise am Ende eines Abwärtstrends beobachtet und ähnelt dem Buchstaben "W" auf dem Chart:

- Das erste Tief. Der Markt steigt höher, was auf eine Korrektur im Abwärtstrend hinweist.

- Das zweite Minimum. Der Markt lehnt das vorherige Minimum der Schwankungen ab. Es gibt hier Käuferdruck, aber es ist noch zu früh zu sagen, ob der Markt weiter steigen kann.

- Halslinie. Der Preis bricht über das Widerstandsniveau aus, was darauf hinweist, dass die Käufer die Kontrolle haben und der Markt wahrscheinlich weiter steigen wird.

Es ist aufgrund dieser Bewegung auf den Charts, dass dieses Modell als W-Musterhandel bezeichnet wird.

Die Quintessenz ist, dass der Preis auf ein neues Tief fällt und dann ein wenig zurückspringt, bevor er wieder auf das neue Tief zurückkehrt. Wenn Verkäufer den Preis nicht weiter senken können, um den Abwärtstrend fortzusetzen, verkaufen sie aus, was zu einem scharfen Preisanstieg von diesem Niveau führt. Die bullische Bestätigung dieses Musters wird durch einen Ausbruch eines wichtigen Preisniveaus bestimmt, das sich auf einem Höchststand zwischen den beiden Tiefs befindet und als Widerstandsniveau (Halslinie) fungiert.

Das Gegenteil des Doppelbodenmusters ist das Doppeltop-Muster. Nehmen Sie dies als bärisches Umkehrsignal wahr, wenn Sie dies im Chart sehen. Es ist ein ebenso leistungsstarkes technisches Werkzeug. Zuerst mögen all diese Schemata zu kompliziert erscheinen. Verwenden Sie die besten Forex-Roboter, um die komplexesten Prozesse zu automatisieren und lernen Sie schrittweise mit minimalen Risiken.

Doppelboden im Devisenhandel

Lassen Sie uns noch tiefer in die Details der Frage eintauchen, „Was ist ein Doppelboden im Forex?“ Wie erkennt man solche Muster auf dem Chart richtig, findet rechtzeitig seinen Weg und welche Ratschläge von professionellen Händlern sollten Sie nutzen, um den Trend zu Ihrem Freund zu machen und weise und richtig zu handeln?

Erkennen eines Doppelbodens auf Forex-Charts

Um mit dem Doppelbodenmuster Forex zu handeln, müssen Sie lernen, dieses Muster auf dem Chart zweifelsfrei zu identifizieren. In der Praxis ist es komplizierter als in den Beispielen, denn auf Ihrem Bildschirm sehen Sie ein Bild in Bewegung, und daher sind Sie gezwungen, so schnell wie möglich zu reagieren, sobald Sie diese oder jene Figur erkennen. Eine kleine Anleitung wird Ihnen helfen, nicht durcheinander zu geraten.

- Suchen Sie zwei verschiedene Tiefs mit der gleichen Breite und Höhe auf dem Diagramm. Der Abstand zwischen ihnen hängt von Ihrem gewählten Zeitrahmen ab, versuchen Sie jedoch, ihn nicht zu kurz zu machen.

- Vergewissern Sie sich, dass Sie das Muster korrekt identifiziert haben, basierend auf dem Widerstandsniveau, das die beiden Tiefs des Musters verbinden sollte.

- Bestätigen Sie das Muster mithilfe anderer technischer Indikatoren: gleitende Durchschnitte oder Oszillatoren.

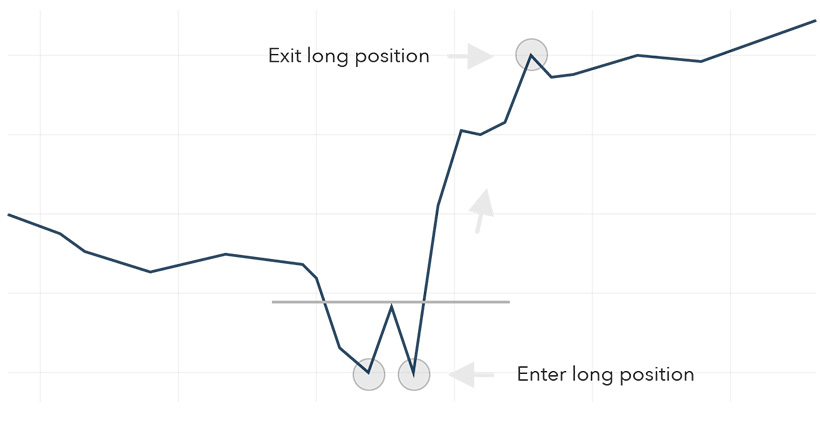

Neben der Konzentration auf Unterstützungs- und Widerstandsniveaus können Sie auch die Technik des "gemessenen Zugs" verwenden, um potenzielle Ziele zu identifizieren, wenn Sie ein Forex-Doppelbodenmuster handeln.

Um ein gemessenes Zugziel zu finden, nehmen Sie einfach den Abstand von den beiden Tiefs bis zur Halslinie und verlängern Sie diesen Abstand bis zum Hoch des Marktes. Wenn beispielsweise der Abstand vom Doppelboden zur Halslinie 170 Punkte beträgt, müssen Sie weitere 170 Punkte darüber messen, um das Ziel zu bestimmen.

Vor- und Nachteile der Forex-Strategie Doppelboden

Die Verwendung des Forex-Doppelbodenindikators bietet den Händlern viele Vorteile, darunter:

- Das Modell liefert ein klares Umkehrsignal. Der Händler erkennt, dass der Abwärtstrend enden könnte und ein Aufwärtstrend wahrscheinlich beginnt. Dies ermöglicht es Ihnen, Positionen zum richtigen Zeitpunkt zu eröffnen.

- Indem sie auf den Aufbau der Halslinie warten, bevor sie einen Handel eingehen, können Händler ihre Exposition verringern und ihr Risiko-Rendite-Verhältnis verbessern.

- Die Technik des Falschen Ausbruchs kann verwendet werden, um von Händlern zu profitieren, die auf der falschen Seite des Marktes gefangen sind.

- Indem Sie mehrere Zeitrahmen verwenden, können Sie die Genauigkeit Ihrer Umkehrtrades erhöhen und eine bessere Vorstellung von der allgemeinen Markttendenz bekommen.

Auch die Risiken und Nachteile des Doppelbodenmusters im Forex existieren, und Sie sollten sich auch ihrer bewusst sein.

- Ein doppelter Boden kann sich bilden, aber der Preis darf nicht über die Halslinie hinausbrechen, was zu einer gescheiterten Umkehrung führt.

- Das Warten auf die Bestätigung des doppelten Bodenmusters, um einen Handel einzugehen, kann zu einem späten Einstieg und damit zu weniger potenziellem Gewinn führen.

- Zusätzlich ist der Prozess der Bestimmung eines Musters auf einem Chart etwas subjektiv, da verschiedene Händler Linien unterschiedlich zeichnen können, was zu unterschiedlichen Interpretationen des Musters führt.

Forex Double Bottom Handelstipps

Hier ist der einfachste Tipp, wie man das Doppelbodenmuster im Forex-Handel handelt. Wenn der Preis unter das erste Tief bricht, eröffnen bärische Händler Short-Positionen und platzieren ihre Stopps über den Tiefs. Wenn der Preis plötzlich steigt, sind diese Short-Trader in ihren Positionen gefangen. Nutzen Sie diese Situation, indem Sie long gehen und erwarten, dass, wenn der Preis weiter steigt, ihre Stopps ausgelöst werden und den Markt zu Ihren Gunsten bewegen.

Dies ist ein wichtiger Tipp. Aber hier sind noch ein paar mehr.

Auf Bestätigung warten

Die Bestätigung erfolgt, wenn der Preis über die Halslinie bricht, was auf eine potenzielle bullische Umkehrung hinweist. Es wird empfohlen, auf einen Ausbruch mit einem signifikanten Anstieg des Volumens zu warten, da dies bestätigt, dass Käufer die Kontrolle haben und der Preis wahrscheinlich weiter steigen wird.

Risiken managen

Verwenden Sie einen Stop-Loss, um potenzielle Verluste zu begrenzen, und riskieren Sie niemals mehr, als Sie sich leisten können zu verlieren. Händler folgen in der Regel einer Faustregel: riskieren Sie nicht mehr als 2% Ihres Handelskapitals in einem einzigen Trade.

Mehrere Zeitebenen verwenden

Dies gibt einen breiteren Blick auf den Trend und hilft, potenzielle Unterstützungs- und Widerstandsebenen zu identifizieren. Ein Händler kann beispielsweise eine höhere Zeitebene verwenden, um einen allgemeinen Trend zu identifizieren, und eine niedrigere Zeitebene, um Ein- und Ausstiegspunkte zu identifizieren.

Kombinieren Sie das Handeln mit doppeltem Boden mit anderen Indikatoren

Ein doppelter Boden signalisiert eine mögliche bullische Umkehr, aber die Kombination mit anderen Indikatoren zur Bestätigung kann nützlich sein. Sie können beispielsweise Oszillatoren wie den Relative Strength Index (RSI) oder den Moving Average Convergence Divergence (MACD) verwenden, um Trendumkehrungen zu bestätigen und überverkaufte Marktbedingungen zu identifizieren.

Das Fazit

Die wichtigsten Regeln, die Sie nach dem Lesen dieser kurzen Lektion beachten sollten:

- Lernen Sie, eine Figur auf einem Diagramm zu definieren. Handeln Sie nicht voreilig, bis Sie sicher sind, dass es sich um das Muster des doppelten Bodens handelt. Hierfür können Sie andere Indikatoren zur Bestätigung wählen oder auf einen Durchbruch warten. Dies wird Ihnen ein besseres Risiko-Rendite-Verhältnis bieten. Warten Sie jedoch nicht zu lange, damit Sie nicht die Chance verpassen, die höchstmöglichen Gewinne zu erzielen.

- Wenn der Preis unter dem 20-MA liegt, lohnt es sich nicht, während eines starken Abwärtstrends in ein Muster des doppelten Bodens zu kaufen. Um unnötige Risiken zu vermeiden, müssen Sie auch einen Stop-Loss setzen und keine Trades für Beträge eröffnen, die Sie sich nicht leisten können zu verlieren.

Denken Sie auch an die Strategie des Falschen Ausbruchs, um von festgefahrenen Händlern zu profitieren. All dies wird Ihnen helfen, mehr aus jedem Trade herauszuholen und weniger Risiken einzugehen. Daher wird Ihr Devisenhandel erfolgreich sein.