MT4 への FXTrackPro Super のインストール手順はとても簡単です。ロボットのインストールファイルをコンピュータにダウンロードし、MT4 の正しいフォルダに配置するだけです。MT4 で EA をインストールして実行する方法を学び、FXTrackPro Super を問題なく取引に活用しましょう。

FXTrackPro Super 詳しくはこちら

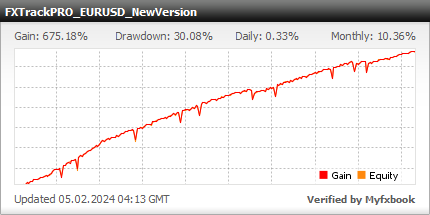

- 総合収益 852.26%

- 毎月 8.18%

- ドローダウン 30.08%

- 商売の日 1286

FXTrackPROは非常に利益をもたらすエキスパートアドバイザーであり、あなたの資本を迅速に増やすことができますが、さらに重要なのは、その収益性により、ご入金のわずかな部分だけで取引し、それでもかなりの利益を得ることができるということです。リスクは低く、利益は著しいです!

統計

FXOpenブローカーは、すべてのSTP口座を閉鎖することを決定しました。その結果、このプロバイダーのいくつか(またはすべて)の口座で取引が中断されました。ただし、口座情報はまだ更新されており、すべての資金が引き出され、失われていないことが明確です。EAは引き続き正常に機能しています。時間の経過とともに、最新の取引データを含む新しい統計が追加されます。詳細はこちらをご覧ください。

特別な状況により、ショップの統計情報は一時的に中断されています。

バックテスト

FXTrackProに関する情報

FXTrackPROには非常に効果的な革新的で技術的なソリューションが多数実装されています。当社の専門家は、3つの異なる種類のインジケーターと同時に作業しています。興味深いことに、EAはそれらを同時に使用せず、アルゴリズムに応じて使用します。これは、FXTrackPROが1つの市場状況では1つのインジケーターからデータを使用して取引を開始し、別の市場状況では別のインジケーターを考慮して最適な取引ポイントを選択し、現在の市場状況に適した取引スタイルを使用することを意味します。このアプローチにより、高い収益性とドローダウンの削減が実現しました。

さらに、外国為替市場での分析と取引に対する当社のアプローチにより、EAを多くの通貨ペアで使用できます。FXTrackPROは次の通貨ペアと互換性があります:EURUSD、USDCAD、GBPUSD、EURJPY、USDJPY、およびAUDUSD。

FXTrackPROの主な特徴

1. 短期間で高い利益を得るか、安定した長期的な収入を得るための低リスクで取引する機会を提供する高い収益性。

2. FXTrackPROはマルチ通貨EAであり、設定に応じて最大6つの通貨ペアを同時に使用できます。

3. MetaTrader 4およびMetaTrader 5プラットフォームで機能するEAの2つのバージョンを同時に入手できます。

4. あなたの口座を予期せぬ損失から保護するリスク管理システム。EAでは、StopLossと市場での注文のオンライン分析による注文の強制クローズの可能性が使用されます。

5. FXTrackPROは「選択された」ブローカー向けに開発されていません。どのブローカーや口座タイプとも互換性があります(まれにMetaTrader 5向けの例外が発生する場合があります)。

6. ロボットの簡単なインストールと設定。すべてが指定されたリスクに応じて自動的に計算されます。

購入に含まれるもの:

FXTrackPro Super - $395

- 各取引口座用のライセンス

- 制限なしでオンラインで口座番号を変更する機会

- MetaTrader 4およびMetaTrader 5との互換性

- 通貨ペア:EURUSD、USDCAD、GBPUSD、EURJPY、USDJPY、AUDUSDで動作

- 無料の終身アップデート

- 24時間体制の信頼性の高いフレンドリーなテクニカルサポート

FXTrackPro - $325

- 各取引口座用のライセンス

- 制限なしでオンラインで口座番号を変更する機会

- MetaTrader 4およびMetaTrader 5と互換性があります

- 通貨ペア:EURUSD、GBPUSD、USDJPYで動作

- 無料の終身アップデート

- 24時間体制の信頼性の高いフレンドリーなテクニカルサポート

返金ポリシー

購入後30日以内に、全額返金保証を提供しています。当社のEAが正常に機能せず、問題を解決できない場合は、返金いたします。口座残高が35%以上減少した場合、当社の推奨設定を使用し、それを証明した場合には、返金手続きも開始いたします。

F.A.Q.

-

リアル口座/デモ口座における FXTrackPro Super の利益はどれくらいですか?

FXTrackPro Superはライブ/デモトレード期間中に852.26%の利益率を達成しました。これらの結果は信頼できる第三者企業によって証明されています。

-

リアル口座/デモ口座における FXTrackPro Super のドローダウンはどれくらいですか?

FXTrackPro Super は、ライブ/デモ取引期間中に最大固定ドローダウン水準 30.08% を維持することができました。

-

FXTrackPro Super の価格はいくらですか?

FXTrackPro Super の公式開発者は、FXTrackPro Super の価格が $395 であることを発表しました。

FXTrackPro EAのレビュー

FXTrackPro EAは、非常に収益性が高く、リスクが少ない取引戦略として位置付けられている最新のForexロボットの1つです。このForexロボットのレビューでは、この自動取引システムの利点と欠点を分析し、長期取引に購入する価値があるかどうかを検討します。

FXTrackPro Super に関する基本情報:

- 価格$345-445

- 通貨ペアEURUSD, USDCAD, GBPUSD, EURJPY, USDJPY, and CHFJPY

- 実際のライセンス数1

- サポート24/7

- 返金30日以内の返金保証

取引の条件:

- 最低入金額$210

- 期間Any

- 端末MT4 and MT5

- ブローカーAny

FXTrackPro Super のライブパフォーマンス

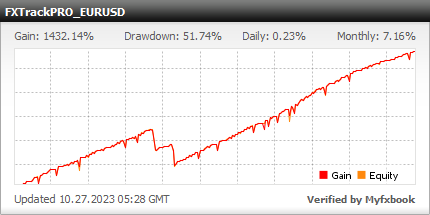

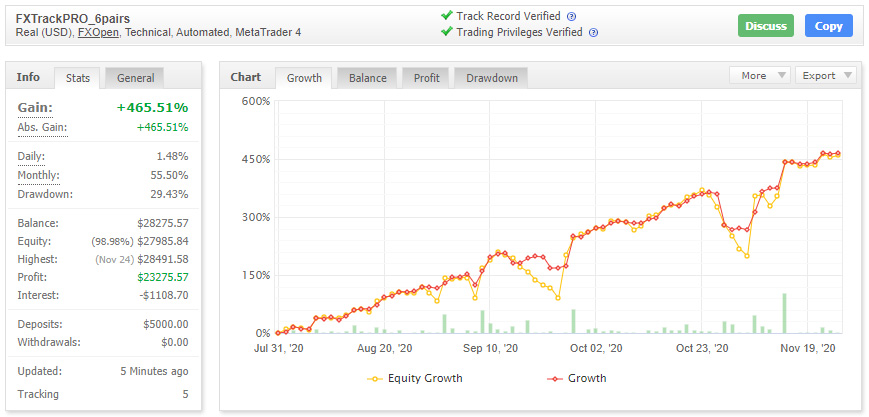

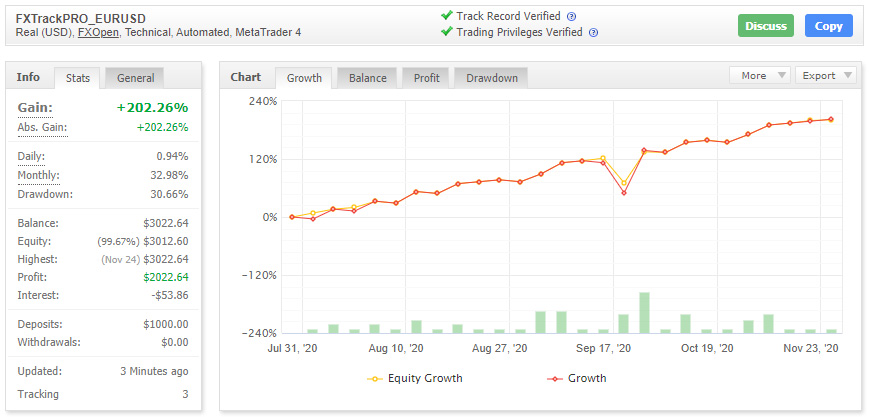

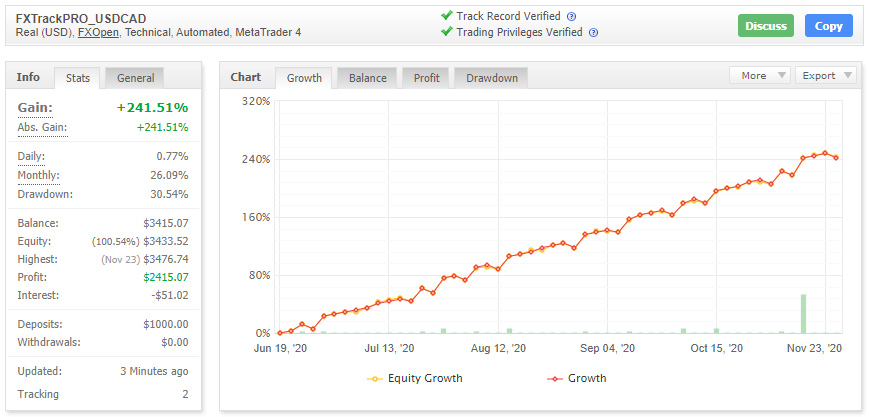

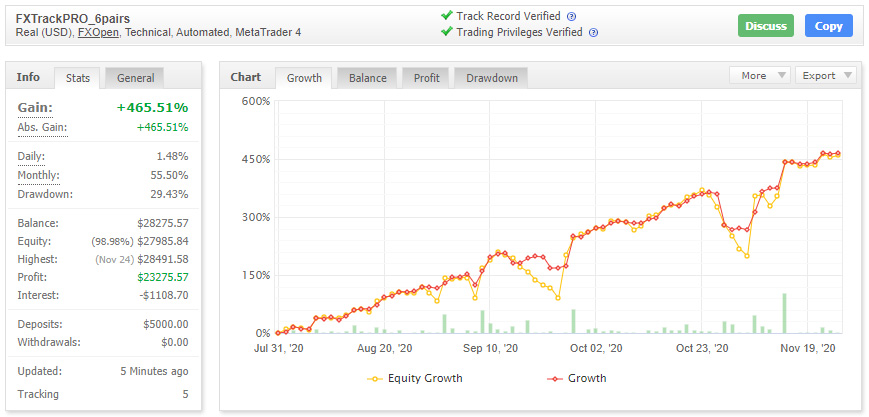

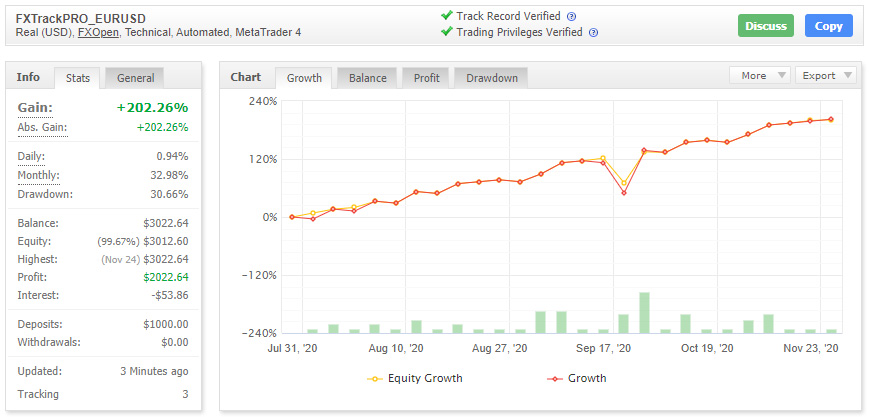

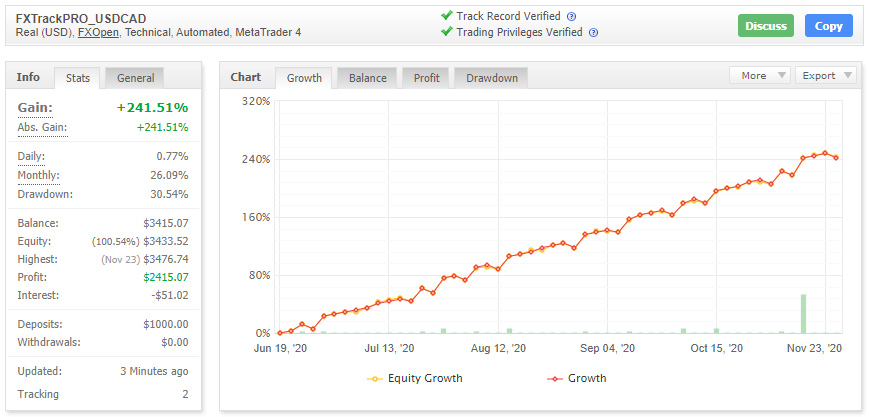

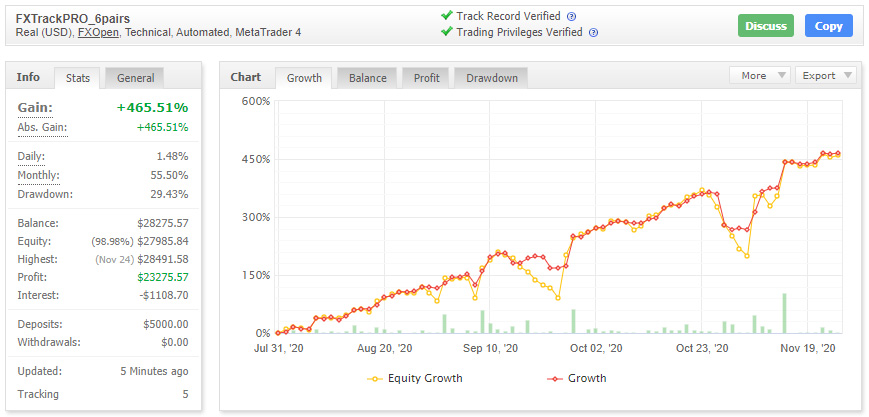

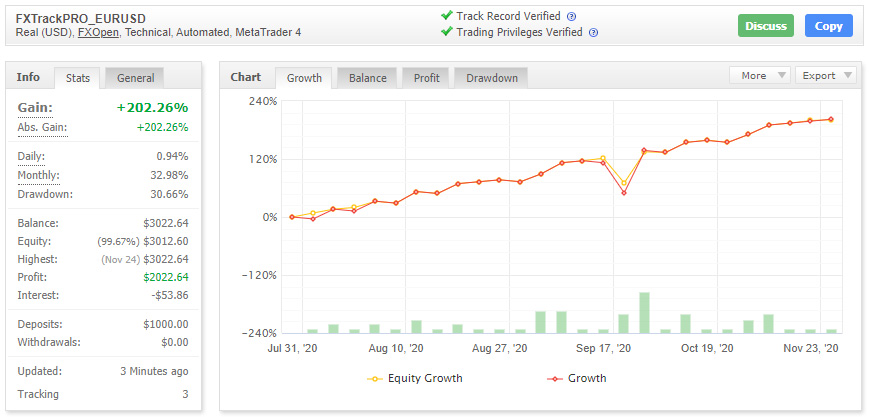

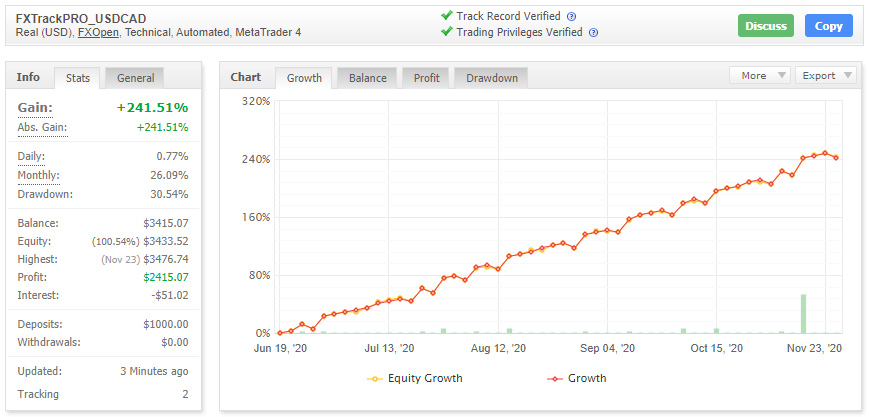

There are 3 live trading accounts of FXTrackPro EA on the Myfxbook third party company that provides objective live trading performance statistics. All of the accounts were set up in June 2020 but have different settings. Live account of the robot work on different currency pairs. While two of them work only on one pair per account: USDCAD and EURUSD, the third account works on all of the six currency pairs the EA is able to trade on. As we can see, the curves are not perfect, having some sharp moves, but still, the main trend for all of the accounts is a strong upward move which signalizes the profitable nature of the robot.

FXTrackPro EA has got a long list of backtests which consists of 12 positions. Developers of this Forex robot made sure that every currency pair the robot is able to trade on is backtested properly. Each of the 6 currency pairs that are supported by the FXTrackPro EA is backtested with high-risk and low-risk trading strategies on the historical quotes from 2017 to 2020.

All the backtests were made on the basic Myfxbook backtester on the 1H timeframe with 90% accuracy which is okay for this EA because it does not use scalping strategy and doesn't need the precise every tick data for its proper work. As we can see from the statistics the EA showed itself very stable and constant.

免責事項

*バックテストは developers’ website の開発者のウェブサイトから取得しています

*その後のアドバイザーの分析は、Myfxbook サイトのライブ分析に基づいています。トレーディングシステムの長所と短所、利益とドローダウンの分析を見ていきます。

収益性とドローダウン

FXTrackPro EAは2つの異なるバージョンで利用可能です:3つの通貨ペア(EURUSD、GBPUSD、USDJPY)で取引を可能にするベースバージョンと、6つの通貨ペア(EURUSD、USDCAD、GBPUSD、EURJPY、USDJPY、CHFJPY)で取引を可能にするスーパーバージョンです。

前述の通り、EAにはMyfxbook上の3つのライブトレードアカウントがあり、それぞれ異なる通貨ペアで取引しています。EURUSD通貨ペアに関するFXTrackPro EAの統計情報は、"FXTrackPRO_EURUSD"という名前のMyfxbookアカウントで利用可能です。USDCAD通貨ペアのパフォーマンス統計は"FXTrackPRO_USDCAD"アカウントで利用可能であり、6つの通貨ペアすべてでの取引統計は、スーパーバージョンのFXTrackPro EAを表す"FXTrackPRO_6pairs"アカウントで利用可能です。

最高パフォーマンスのロボットアカウントは、6つの通貨ペアで取引するFXTrackPro Super EAです。わずか5か月のライブトレードで、EAは462.98%の利益を上げ、最大ドローダウンの水準は29.43%でした。

FXTrackPro Super EAのすべてのライブトレード統計を考慮すると、利益とドローダウンの比率は約3:1であり、実際にはかなり高いと言えます。

他の2つのアカウントは、利用可能なForexロボットの平均と比較してかなり高いレベルですが、それでもパフォーマンスレベルは低いです。FXTRackPro EAは、EURUSD口座で202.26%の利益、USDCAD口座で241.51%の利益を示しており、わずか5ヶ月のライブ取引とそれぞれ30.66%と30.54%のドローダウンを考慮すると、非常に良い結果と言えます(以下のスクリーンショットを参照)。

これら2つのライブ口座の利益対ドローダウン比率はかなり似ており、対応する統計も近いです。したがって、EURUSD口座の比率は1.3:1で、USDCAD口座の比率は1.5:1です。これらの結果は、わずか5ヶ月の取引であることを考慮すると、印象的です。USDCAD口座では、ほぼ40%の追加利益があり、比率の比較では0.2ポイント多く獲得しています。

収益性とドローダウン

FXTrackPro EAは2つの異なるバージョンで利用可能です:3つの通貨ペア(EURUSD、GBPUSD、USDJPY)で取引を可能にするベースバージョンと、6つの通貨ペア(EURUSD、USDCAD、GBPUSD、EURJPY、USDJPY、CHFJPY)で取引を可能にするスーパーバージョンです。

前述の通り、EAにはMyfxbook上の3つのライブトレードアカウントがあり、それぞれ異なる通貨ペアで取引しています。EURUSD通貨ペアに関するFXTrackPro EAの統計情報は、"FXTrackPRO_EURUSD"という名前のMyfxbookアカウントで利用可能です。USDCAD通貨ペアのパフォーマンス統計は"FXTrackPRO_USDCAD"アカウントで利用可能であり、6つの通貨ペアすべてでの取引統計は、スーパーバージョンのFXTrackPro EAを表す"FXTrackPRO_6pairs"アカウントで利用可能です。

最高パフォーマンスのロボットアカウントは、6つの通貨ペアで取引するFXTrackPro Super EAです。わずか5か月のライブトレードで、EAは462.98%の利益を上げ、最大ドローダウンの水準は29.43%でした。

FXTrackPro Super EAのすべてのライブトレード統計を考慮すると、利益とドローダウンの比率は約3:1であり、実際にはかなり高いと言えます。

他の2つのアカウントは、利用可能なForexロボットの平均と比較してかなり高いレベルですが、それでもパフォーマンスレベルは低いです。FXTRackPro EAは、EURUSD口座で202.26%の利益、USDCAD口座で241.51%の利益を示しており、わずか5ヶ月のライブ取引とそれぞれ30.66%と30.54%のドローダウンを考慮すると、非常に良い結果と言えます(以下のスクリーンショットを参照)。

これら2つのライブ口座の利益対ドローダウン比率はかなり似ており、対応する統計も近いです。したがって、EURUSD口座の比率は1.3:1で、USDCAD口座の比率は1.5:1です。これらの結果は、わずか5ヶ月の取引であることを考慮すると、印象的です。USDCAD口座では、ほぼ40%の追加利益があり、比率の比較では0.2ポイント多く獲得しています。

収益性とドローダウン

FXTrackPro EAは2つの異なるバージョンで利用可能です:3つの通貨ペア(EURUSD、GBPUSD、USDJPY)で取引を可能にするベースバージョンと、6つの通貨ペア(EURUSD、USDCAD、GBPUSD、EURJPY、USDJPY、CHFJPY)で取引を可能にするスーパーバージョンです。

前述の通り、EAにはMyfxbook上の3つのライブトレードアカウントがあり、それぞれ異なる通貨ペアで取引しています。EURUSD通貨ペアに関するFXTrackPro EAの統計情報は、"FXTrackPRO_EURUSD"という名前のMyfxbookアカウントで利用可能です。USDCAD通貨ペアのパフォーマンス統計は"FXTrackPRO_USDCAD"アカウントで利用可能であり、6つの通貨ペアすべてでの取引統計は、スーパーバージョンのFXTrackPro EAを表す"FXTrackPRO_6pairs"アカウントで利用可能です。

最高パフォーマンスのロボットアカウントは、6つの通貨ペアで取引するFXTrackPro Super EAです。わずか5か月のライブトレードで、EAは462.98%の利益を上げ、最大ドローダウンの水準は29.43%でした。

FXTrackPro Super EAのすべてのライブトレード統計を考慮すると、利益とドローダウンの比率は約3:1であり、実際にはかなり高いと言えます。

他の2つのアカウントは、利用可能なForexロボットの平均と比較してかなり高いレベルですが、それでもパフォーマンスレベルは低いです。FXTRackPro EAは、EURUSD口座で202.26%の利益、USDCAD口座で241.51%の利益を示しており、わずか5ヶ月のライブ取引とそれぞれ30.66%と30.54%のドローダウンを考慮すると、非常に良い結果と言えます(以下のスクリーンショットを参照)。

これら2つのライブ口座の利益対ドローダウン比率はかなり似ており、対応する統計も近いです。したがって、EURUSD口座の比率は1.3:1で、USDCAD口座の比率は1.5:1です。これらの結果は、わずか5ヶ月の取引であることを考慮すると、印象的です。USDCAD口座では、ほぼ40%の追加利益があり、比率の比較では0.2ポイント多く獲得しています。

最終成績

ロボットの価格は、開発者が提供する品質と比較してかなり高いです。FXTrackPro EAはこれまでに良好な取引結果を収め、Myfxbookに実際の口座の長いバックテストリストといくつかのリアルアカウントを持っています。30日間の返金保証と24時間365日のサポートもあります。これらすべては、5つ星中5つ星を与えるのに十分です。 ロボットの収益性とドローダウンの比率は非常に高いです(最大3:1、最小1.3:1)、これにより、5つ星中5つ星未満の評価をする他の選択肢がありません。 実際の口座での現在の取引期間は5か月で、私はレビューで一般的な結論を導くのに十分ですが、同じ取引品質でより良い結果を得るためには、ロボットが少なくともさらに6〜7か月はライブで動作する必要があります。 USDCADの統計には6か月のライブトレードがあり、ここでは5つ星中3つ星を与えることができます。 開発者は高品質のバックテストの長いリストを提供するようにしており、これはシステムの潜在的な収益性や寿命について多くを語っています。また、システムを使用したさまざまな取引バリエーションを示しており、これは肯定的ですが、バックテスト期間がもう少し長くなる可能性があるため、ここでは5つ星中4つ星を与えます。 このForexロボットに対する私の意見は肯定的です。FXTrackPro EAとの取引はかなり利益が出ており、リスクも許容範囲内です。また、開発者がロボットパッケージに含めたすべての機能と適切な価格は、5つ星中4つ星を与えるのに十分です。前述のように、ロボットは長期的な視点からの一貫性を証明する必要があり、より高い評価を受けるためには。

このレビューの作成時点では、ForexStoreの自動評価システムはFXTrackPro EAを10点中8点で評価しました。これは、私がこのForexロボットを検討した後に考慮した評価とまったく一致しています。

トレーダーの皆様にお役立ちできれば幸いです!収益性の高いトレードと市場での幸運をお祈りしています!