在外匯市場存在的整個歷史中,交易員提出了數十種不同的策略,幫助他們取得成功並賺取可觀的收入。然而,所有這些策略可以分為三類:長期、短期和剝頭皮。日內交易是一種短期類型,涉及在一天內開倉和平倉。

最常見的是,這種交易被選擇為將外匯視為日常工作的市場參與者。該策略需要積極參與,但仍不像剝頭皮那樣激烈。大多數情況下,交易員在一天內只能開倉和平倉一次。

高市場波動性使您能夠抓住重大價格波動並獲利而無需長時間等待。也許這就是為什麼日內交易是外匯交易者中最受歡迎的風格。本文將探討這種策略的特點、優點和缺點。此外,在閱讀後,您將獲得一個逐步計劃和詳細建議來開始日內交易。

外匯日內交易的關鍵特點

在一些資料中,您可以找到“日內交易”一詞。這些概念是可互換的,具有相同的含義。該方法的基本特點如下:

- 交易员保持头寸不超过24小时。这样可以避免掉期成本。

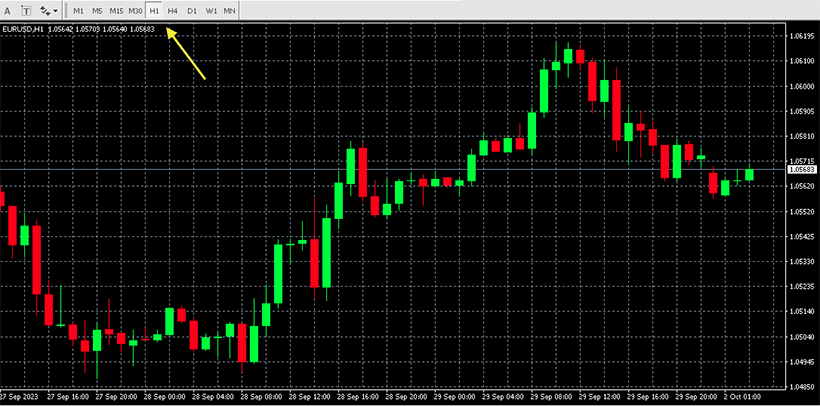

- 分析最流行的时间框架是H1。然而,为了进一步确认信号,交易员经常使用M30和H4。

- 日内交易可以让您在没有大额存款的情况下赚钱。

- 与剃头交易不同,头寸通常会保持几个小时,这给了交易员分析情况和谨慎使用必要技术工具的时间。

- 几乎没有价格噪音,这对于短期策略是常见的。

- 经纪人更愿意与日内交易者合作,而不是剃头交易者。

- 某些日内交易货币对的波动性在一天内可以达到10%。

外汇日内交易策略是初学者中的热门选择。首先,它需要对市场的关注,并帮助快速获得重要经验。其次,日内交易方法允许您从今天开始用较小的存款开始赚钱。

高频交易

有时,另一种策略被包括在日内交易类别中 - 高频交易(HFT)。从技术上讲,它也涉及在一天内进行交易,但具有完全不同的特点。例如,HFT通常使用自动算法,在没有直接人为干预的情况下开启和关闭头寸。

当然,高频交易需要适当的设备和软件。为了每天进行数十甚至数百次交易,通常会使用带有高速互联网的远程服务器。此外,交易员使用先进的机器人算法,考虑市场中最微小的波动并分析数十个因素。通常,大型参与者(对冲基金、银行和其他资源丰富的机构)使用HFT策略。

短持仓期

對於成功的日內交易,了解持有期是很重要的。這是開倉和平倉之間的時間。例如,如果你在早上開倉,並在晚上平倉,那麼持有期將是購買和銷售之間的那幾個小時。如上所述,使用外匯日內交易系統,持有期不能超過24小時。通常,交易者將持倉開放長達10個小時。然而,在高波動性的情況下,這個期限可能會更短。

日內波動性

日內波動性是交易者的收入來源。它是資產最高價格和最低價格之間的差異,實際上是最大的利潤價值。有經驗的外匯市場參與者知道,要成功交易,他們應該查看圖表並分析導致市場波動性的外部因素。這使他們能夠及時看到新趨勢的開始並開倉。

像USD/EUR這樣的熱門交易對很少有高波動性。一些交易者更喜歡波動幅度高達3-5%甚至更高的罕見資產。然而,熱門貨幣的高流動性也為穩定收益提供了機會。最重要的是要充分了解特定資產的特點,不要受到瞬間情緒的影響。

成為外匯日內交易者需要什麼?

選擇交易策略通常取決於一個人的心理和個人喜好。如果你不想等待很長時間,並且希望快速看到工作成果,外匯日內交易可能是你的理想選擇。它也適合那些喜歡分析市場並做出明智決定的細心交易者。

如果這個描述符合你的性格,你可以開始邁出第一步。一般計劃如下:

- 研究经纪人。您需要深入了解经纪人的工作方式,初学者提供的条件,您需要的初始存款等。通过所有可能的参数(点差,杠杆,附加服务)比较各种报价。选择一个中介是决定未来日内交易成功的重要步骤。

- 研究市场。分析主要货币对过去几天的价格变动。确定一天内的平均和最大波动性。阅读专家的评论和预测,看看它们的准确性如何。在存款之前,您需要了解如何进行交易。

- 研究交易平台。如果不了解平台的功能,就无法开始交易。您必须能够使用主要指标,更改时间框架,并了解日本蜡烛图案的关键模式。您可能需要参加培训课程或进行一些咨询。

- 确定资本。如果您是初学者,我们不建议借钱开始外汇之旅。存款应该对您来说是可以承受的。这将使您摆脱对资本的不必要责任,并使您能够在没有情绪的情况下进行交易。

- 策略。任何外汇日内交易者都知道,没有策略的交易很少会成功。制定一个计划,以及在不同情况下的行动。改进您的策略,并继续朝着目标前进。

日内交易是一种有利可图的交易方式,可以为您带来可观的日收入。然而,这也需要外汇知识,辛勤工作和良好的准备。

日内交易者的工具和资源

如今,交易离不开技术工具和数字资源。您的资源基础可以分为两部分:硬件和软件。让我们从日内交易者需要的物理设备开始:

- 个人电脑。由于交易执行速度很重要,您需要一台具有足够内存和体面处理器的个人电脑。这还将使您能够连接多个MT4/5终端。

- 智能手机。日内交易策略要求您快速响应市场变化。因此,您的移动设备也安装有交易平台非常重要。另一个优势是关于价格波动的通知。它们让您不会错过信号,也不会失去利润的重要部分。

- 高质量路由器和高速互联网。数据传输速度和稳定连接对交易者至关重要。当您需要快速开仓和平仓时,这一点尤为重要。

- 远程服务器。如果您已经达到一定水平,也许您想扩展并连接额外的终端。优质的VPS将使您能够无限制地交易。如果您旅行并且不想停止交易,这也很有用。

除了物理设备外,您还需要数字资源,例如分析程序或交易环境。让我们更详细地考虑它们:

交易平台。大多数交易者选择Meta Trader 4或5。它们包含必要的技术分析工具,并且可以升级。

专家顾问。这些是搜索和分析交易信号的紧凑程序。这些最佳外汇机器人比人类工作速度快得多,并且如果使用正确,可以显着增加您的利润。

额外指标。一些高级工具需要花钱,并且可以安装在您的MT4平台上。它们可以提供更准确的信号。

分析资源。为了找到有关市场的信息,您可能需要具有最新分析的知名网站。

外汇日内交易是一项令人兴奋的职业,需要时间去习得。然而,只要有基本资源,如一台电脑、互联网和几个程序,就能让你谋生并确保财务稳定。

外汇日内交易的最低起步金额

交易的最低金额始终与两个因素相关:盈利目标和风险管理。目标越高,你需要的起始资本就越稳固。然而,风险承受能力也决定了初始存款和交易策略。

如果你是一名初学者交易员,一个不错的选择是从模拟账户开始。这将让你测试策略并了解你需要多少钱才能实现目标。然而,模拟交易只是第一步,要获得真正的收益,你需要投资。

在计算金额时,重要的是要记住经纪人提供杠杆。不同的经纪人和服务包可以有1:500、1:1000、1:2000甚至更高的比率。这意味着你可以用100美元的存款交易从5万到20万美元。

接下来,你需要查看你选择的货币对的平均汇率波动。当然,你不会把整个存款用于一个头寸 — 这也应该考虑在内。最终,你将得到一个基于你的目标、优选资产和风险承受能力的金额。

许多初学者用几百美元开始他们的外汇之旅。这通常被认为是最低起步金额。然而,如果你有抱负,最好在获得经验和知识的过程中将资本增加至至少几千美元。

外汇日内交易策略

外汇日内交易是一个概念。你只受到每日时间框架的限制,交易的所有其他方面都可能不同。我们建议你考虑几种这种交易的方法:

- 剃头。这是最具动态性的策略,交易员在几分钟的小时间框架内进行交易。同时,一天内的交易次数可能相当多。

- 范围交易。通过它,您试图确定货币对的支撑和阻力水平,并在它们之间进行交易。

- 分析交易。交易员分析市场情绪和各种经济和政治激励因素,以预测价格的走势。

当然,还有数十种其他的日内交易方法。您可以结合、补充和改进它们。

日内交易中的风险管理

为了有效地管理风险,您需要了解在日内交易外汇中可能会遇到的情况。以下是一些需要考虑的负面因素:

- 由于突发新闻而导致趋势突然向不利方向变化。为了避免巨大损失,建议使用止损。

- 开仓较晚可能导致最小利润甚至亏损。使用更多的技术分析工具进行更准确的评估。

- 技术问题。在最不合适的时刻,电源或互联网可能中断。使用不间断电源和始终备用互联网来源。

- 人为因素。奇怪的是,情绪决策是造成财务损失最常见的原因之一。尽量遵循您的策略,并基于事实做出决策。

风险管理是交易的重要组成部分,这些建议可以帮助改进它。

外汇日内交易规则和技巧

为了获得最有利可图的交易,您可以使用以下外汇日内交易规则:

- 确定您在策略中将使用的工具。

- 在做决定时确定指标(主要和次要)的优先级。

- 确保设置止损和获利订单。

- 确定您将专注的模式。

- 在市场开放后至少等待半小时再开仓。

- 不要在新闻发布期间开仓。

- 从最低存款开始交易,并在获得足够经验之前不要冒太大风险。

经验是外汇成功的基础。使用这些提示将帮助您在没有太大损失的情况下获得必要的实践。

外汇日内交易中要避免的常见错误

除了知道该做什么,交易者还应该了解不应该做什么。以下是日内交易时一些流行的不要做的事情:

- 不要试图通过开设过大的新头寸来抵消亏损交易。

- 不要过早开仓,期望一些新闻效应。

- 不要在一笔交易中冒太大的风险。

- 不要期望太多。交易需要随着时间而来的技能。

最后,不要害怕犯错误并从中学习。这将帮助您迅速成为专业人士。现在您知道了外汇日内交易是什么,让我们总结一下信息。

外汇日内交易的优缺点

在我们总结这篇评论之前,让我们总结一下日内交易的优缺点。让我们从优点开始:

- 没有隔夜利息。交易在一天内开启和关闭。

- 有时间进行分析和明智的决策。

- 从快速利润中获得心理满足感。

此外,一些缺点是显而易见的:

- 日内交易中的点差可能会影响利润。

- 存在重大风险。

- 交易需要大量的注意力和时间投入。

正如我们之前所说,日内交易需要特定的先决条件和偏好。然而,如今,24小时是大多数交易者最喜欢的工作时间。

最重要的是

日内交易者可以每天从价格波动中赚取可观的利润。在本文中,我们探讨了这种交易风格的特点,并提供了一个逐步计划以便入门。在开始之前,您需要权衡利弊并做好充分准备。当然,存在风险,但对外汇的知识、经验和兴趣将帮助您开创成功且有利可图的职业生涯。