锤子线是最受欢迎的蜡烛图形态之一。它既可以作为交易系统的基础,也可以作为确认其他信号的辅助方法。该图形本身仅由一根蜡烛组成。它在图表上立即可见,因此非常受欢迎。锤子线蜡烛是通用的,适用于任何市场。本文讨论了这种图形以及如何开发外汇锤子线策略。

蜡烛图形态基础

“锤子线”一词是“匹诺曹线”(Pinnochhio bar)的简称,指的是一个倾向于说谎的角色。该图形看起来像一根蜡烛,具有一个小身体和一侧的长影线。有两种类型的锤子线。第一种是熊市锤子线。它有一个很长的上影线。第二种是牛市锤子线,具有很长的下影线。

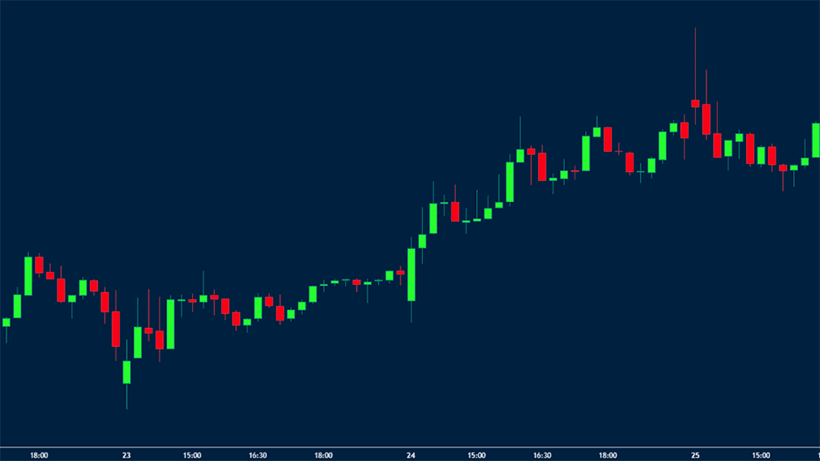

牛市蜡烛通常出现在市场底部。长影线是由熊市企图将价格进一步推低而解释的。但市场拒绝了继续下跌趋势的可能性,曲线发生了逆转。由于卖家的攻击被击退,下影线很长,比身体大小大几倍,而上影线明显较小或不存在。

熊市图形是根据类似的逻辑形成的,但交易者的行动顺序是相反的。多头方试图继续上涨并更新最高点,但卖家设法夺取主动权。长影线应位于蜡烛的顶部。

理解锤子线蜡烛图形态

只有在内容中才能理解锤子线蜡烛的含义。例如,图表上蜡烛的位置很重要。如果没有预先的运动,市场是平的,我们不能说形成了图形。换句话说,可能会出现假锤子线蜡烛。

下一个因素是蜡烛芯的长度。通常,它必须比短影线长五倍。显然,没有严格的规则,对于不同的货币对和市场而言是个体化的。然而,较长的蜡烛芯表明市场上有强烈的阻力。最后但同样重要。如果我们在上升趋势的顶部观察到一个看跌的Pin Bar,它必须是红色的。反之,看涨的Pin Bar应该是绿色的。如果所有三个条件都符合,那么趋势反转的可能性很高。

Pin Bar蜡烛图案的重要性

我们上面提到了观察Pin Bar时上下文的重要性。否则,这种图案可能对交易者不利。初学者经常被其简单性所愚弄,并在看到这样一个蜡烛时迅速做出决定。但是,只有当满足所有周围条件时,看跌或看涨的Pin Bar图案才真正重要。

经验丰富的交易者通常将其用作辅助信号而不是主要信号。现代交易程序允许利用许多技术指标。您可以使用其他工具,如吞没模式、拋物线SAR等。几个强有力且不矛盾的信号将突显Pin Bar的重要性,并有助于做出明智的决定。

如何交易Pin Bar蜡烛图案

要成为专业交易者,重要的是获得自己的经验,并建立一个基于您对市场和交易过程的理解的策略。您可以通过在模拟账户或真实账户上犯许多错误来积累这种经验。然而,以下提示将帮助您减少损失,并在处理Pin Bar蜡烛图案时犯更少的错误:

- 优先考虑来自更高时间框架的信号。每周的Pin Bar比H1-H4尺度的图案更强。

- 请记住,模型在较低的时间间隔下可靠性显著下降。您可以在M1-M5上找到许多有效的模式,但实时操作这些时间框架可能会很困难。

- Pinbar的存在并不意味着价格会立即朝着期望的方向移动。需要过滤器,但即使它们存在,也有可能模式不起作用。

- 始终设定止盈和止损。这将降低风险水平。风险管理是任何Pin Bar交易策略的强制部分。

- 不要使用带有过长阴影的图案。它们表明市场不确定性,趋势可能会继续。

如果您正在使用基于图表反转的Pin Bar策略,Pin Bar可以帮助您。它们很容易确定,如果您考虑其他信号,您可以抓住新趋势的开始。

Pin Bar蜡烛图案的优势和限制

Pin Bar图案有许多优点,包括简单性(它只由一个蜡烛组成)、可见性和清晰的结果。这使得它相当受欢迎,特别是在新手交易员中。但也很重要记住它的限制。忽视这些限制可能导致人们在Pin Bar交易时犯下不同的错误:

- 相信市場在出現壁釘棒後將總是會逆轉。一個上升趨勢不會僅僅因為圖表上出現了一根看跌的壁釘棒而結束。要逆轉一個長期趨勢需要更多因素。如果你在圖表上看到一根壁釘棒與趨勢相反,請看看接下來會發生什麼。目前的趨勢有可能會繼續。

- 缺乏對其他信號的關注。由於其簡單性,在外匯市場中,壁釘棒通常是做出決定的核心因素。然而,如果你只關注壁釘棒,你可能會錯過許多其他交易機會。為了避免這個錯誤,有必要對市場有全面的了解,並理解價格波動。

- 在每根壁釘棒後做出相同的決定。實體和影線非常重要,因為它們顯示誰控制著局勢 —— 賣家還是買家。同時,還值得考慮壁釘棒出現前的價格走勢和蠟燭的大小。

如果交易者將壁釘棒視為普遍且沒有錯誤模式,那麼所有這些錯誤可能會發生。這並不是真的。壁釘蠟燭圖有其局限性,絕對不是交易者工具箱中最精確的工具。如果明智地使用它,它將給你有用的信息;否則,它可能會誤導你。

結論

壁釘蠟燭圖案在外匯市場上非常常見。它簡單、清晰且易於檢測。其巨大優勢在於這種圖案信號趨勢反轉,通常會帶來可觀的利潤。它值得你的關注,並可以為你提供有價值的信息。同時,壁釘棒應僅在一個上下文中進行分析,並應考慮其他指標以做出更好的決策。為提高效率水平,你可以使用最佳外匯機器人。它們肯定會提升你的表現。