對於初學者交易者來說,最重要的是學會如何預測趨勢反轉。但是當完成這項任務後,您可以繼續進行更複雜的預測,並對價格將下跌或上漲多少做出預測。外匯頭肩圖案受到全球交易者的尊重,正是因為它能夠很好地執行這兩項任務。外匯圖表上的頭肩圖案是什麼意思?找出如何檢測這個圖案,您將獲得一個可靠的指標,被認為是最有效的技術分析工具之一。

什麼是頭肩圖案?

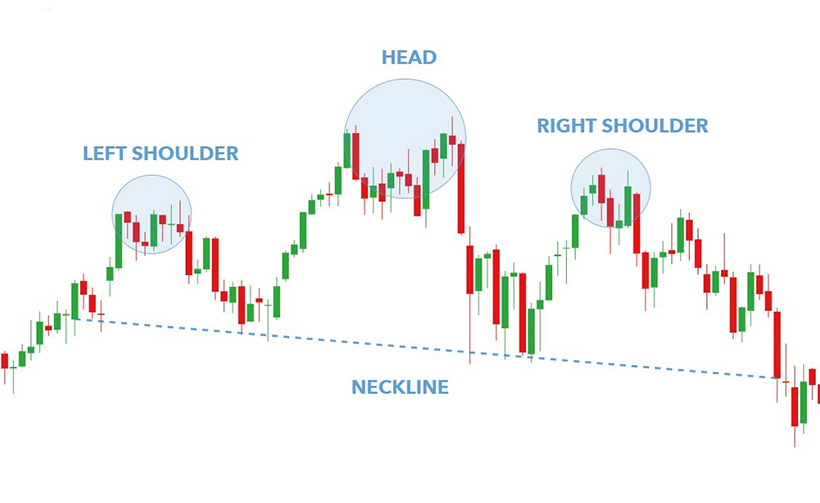

觀察貨幣價格波動的動態,交易者可以辨別出不時重複出現的各種圖案。長時間觀察後,分析師們注意到這些圖表蠟燭圖案可以成功應用於交易。其中一個重要的圖案被稱為外匯頭肩圖案。它出現在以下情況下:

- 資產價格急劇上升可能導致多頭和空頭趨勢之間的長期鬥爭。

- 在這種情況下,圖表上的蠟燭形成一定的圖案,有三個價格高峰和兩個低谷,視覺上類似於一個頭部和兩個肩膀。

- 在第三個高峰過後,價格開始快速下滑,空頭市場獲勝。鬥爭一直持續到空頭趨勢耗盡。

頭肩圖案特點

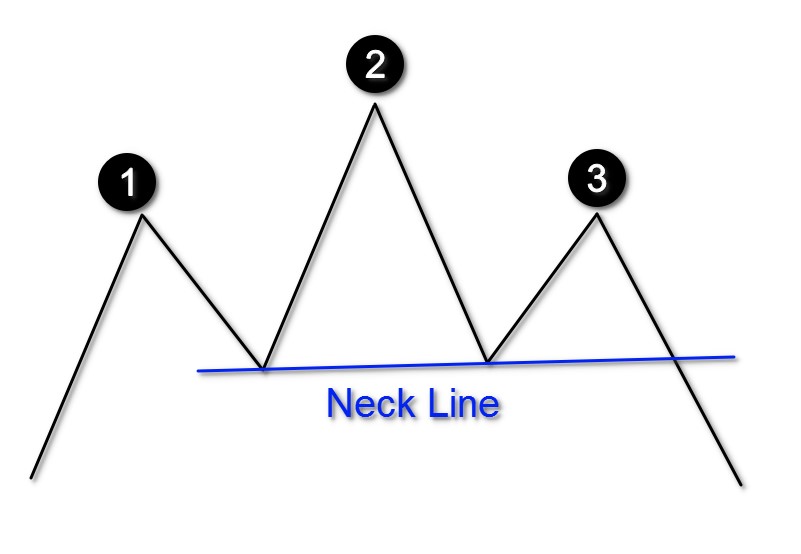

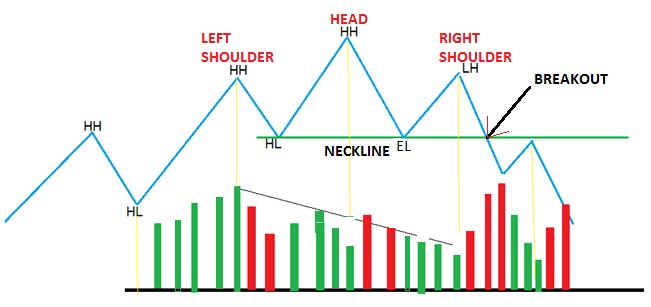

為了視覺上突出頭肩模型,請在價格走勢圖上找到所有必要的組件:

- 左肩:牛市趋势逐渐增长,达到第一个高点,但无法立足,让位给短暂的熊市趋势。

- 头部:头肩顶图表模式的中间高峰是最高的,因此类似于一个头部,高耸在两个大致相同高度的肩膀之上。在暂时的熊市趋势再次被征服新高的牛市趋势取代后形成。经过它的过程后,价格再次下跌。

- 右肩:离开第二个低谷后,牛市趋势的第三次也是最后一次上升开始。这一次,它无法上升到头部的水平,让位于大约第二个肩膀的水平处的长期熊市趋势。

- 颈部:如果不考虑颈部的水平,头肩图形交易模式将是不完整的。预测资产价格在颈线突破后将下跌多少是很重要的。一旦这条线被突破,可以说熊市已经在这场长期的斗争中获胜,这意味着这是一个卖出信号。

为了不错过头肩图形的突破,使用最佳外汇机器人。它们的算法可以追踪这个和许多其他模式,并及时作出反应。

反向头肩顶交易模式

在资产价格急剧下跌然后两种趋势之间的长期斗争的情况下,也存在这种交易模式。在这种情况下,它看起来像反向头肩顶外汇:

- 价格图表中有三个槽,中间的槽最深。现在,这不是资产的最高价,而是最低价。

- 在头部和肩膀之间有两个峰值;在这种情况下,它们是暂时的看涨趋势。

- 当看涨趋势经过长时间的斗争后获胜时,颈线最终突破。然而,在倒头肩的情况下,这不是卖出的信号,而是买入货币的信号。学习外汇交易技巧,了解何时更好地开立卖单和何时买入货币。

外汇中的头肩交易图案

这种图案的多功能性使其适用于交易任何资产。头肩股票图案对于准确确定有利可图的股票销售或购买时间同样具有重要价值。然而,在外汇市场中使用头肩图案时,人们不仅应该了解其机会,还应该了解其弱点。

头肩图案的优势

- 這個指標在預測趨勢反轉方面是最可靠的之一。因此,如果您在圖表上看到它,錯誤的機率是最小的。

- 頭肩頂技術分析使交易者能夠相當準確地預測資產價值在模式最終形成後的下跌水平。通過測量頸線到頭部頂部的距離來計算。突破頸線後,價格將下跌大致相同的幅度。

- 看漲的頭肩底圖案有三個谷底,顯示此時交易者不應急於購買貨幣,因為趨勢的鬥爭還沒有結束。同樣地,當直接頭肩頂圖案外匯達到峰值時,應該預期資產價格會提前下降,然後再次上升。

頭肩頂圖案的缺點

- 有可能收到賣出貨幣的虛假信號,因為一旦價格運動達到頸線,長期上升趨勢可能會再次回來。然而,在85%的情況下,該模型將給出明確準確的信號。

- 由於該模式形成的時間較長,交易者可能會錯過開倉的機會。當交易者期望看到貨幣或股票圖表的頭肩頂圖案,但最終未形成時,就會發生這種情況。

優勢

- 頭肩頂和頭肩底圖形規則的多功能性使它們適用於任何市場。

- 為外匯市場的空頭交易和其他策略提供可靠信號。

- 允許交易者看到宏觀趨勢的形成並在進行長期投資時利用這一知識。

- 提供了進行風險和預期回報的準確計算的機會。

劣勢

- 等待這種圖形完成的時間過長可能會導致錯失機會。

- 頸線可能會移動,這將導致計算錯誤。

結論

在本地和全球背景下,外匯頭肩頂和頭肩底圖形意味著什麼?從實際角度來看,它顯示了在長時間奮鬥後熊市趨勢最終獲勝的時刻。這意味著此時開立賣單將不會帶來不愉快的驚喜。在頭肩底圖形的情況下,您將能夠看到在突破哪條線後牛市趨勢獲勝。之後,您可以安全地購買貨幣,期待其價值上升。

從更基本的角度來看,外匯頭肩頂和頭肩底圖形展示了趨勢鬥爭的規律。頭肩頂和頭肩底圖形是如何工作的?

- 第一个峰值或第一个肩膀在无法在此水平站稳后,向下趋势。

- 然而,未实现的增长潜力再次推动它上升,并允许达到最高峰,随后下降。

- 第三次尝试攀升价格是最后一次,耗尽而未达到先前高度后,让位于相反的趋势。

了解趋势斗争的逻辑,并能够在图表上直接位置或作为倒头肩目标看到它们,您可以正确计算外汇策略并在交易中取得重大成功。