FX FastBot Advanced 更多信息

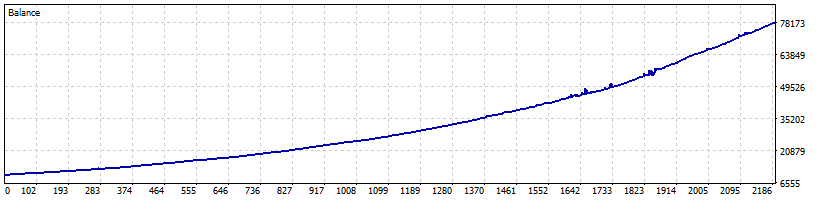

- 利润总额 212.84%

- 月次 3.69%

- 下垂 40.29%

- 交易日 944

FX FastBot Avanzato - 高速交易,精準交易。

使用我們的FX FastBot EA,您可以期待快速的交易結果。通常情況下,從開倉到獲利只需數小時。

统计

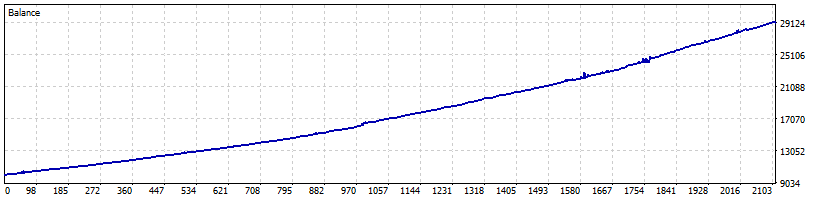

交易系统对报价历史的测试

关于FX FastBot Advanced的信息

我们发现了一种非常有效且成功的独特策略。这利用了AUDCAD货币对的特定特征,并最大限度地发挥其潜力。值得注意的是,这种特征是一贯的,而不是暂时的:第一个实盘账户于2021年开设(Moderates Profil (V1))。这个机器人运行非常快,通常在几个小时内(有时在同一天内)完成订单。它提供持续稳定的利润,没有亏损期。大多数配置的获利水平约为100点(10点),但Envelopes指标使用我们的调整,与获利水平和动态相关联。

我们的机器人有4个交易配置文件(FX FastBot Advanced),每个都有独特的设置和特征。此外,这些配置文件根据风险水平进行分类:配置文件名称中有所示。最大的区别在于高风险配置文件,同时在AUDCAD和EURUSD两个货币对上运行,利用主动订单来获得高利润或通过一方的损失来弥补另一方的利润。换句话说,它们相互协作,实时分析彼此。

推荐

FX FastBot对于点差没有特别严格的要求。AUDCAD在常规账户中的最大点差应低于40点(4位数价格为4点)。对于ECN账户,应低于15点。EA配备了内置系统,如果点差突然超过推荐水平,则不会开立订单。但是,一旦点差再次正常化,并且订单价格相同或更低,FX FastBot将开立订单。当然,您可以通过更小的点差获得更多利润。

如果以100%的风险交易,则杠杆应为1:100或更高。随着风险增加,杠杆要求会降低。此外,根据所选的配置文件设置,建议最低存款为$600至$1500。

注意!此机器人可以与美国经纪商(NFA)合作,但仅限于补偿账户。

主要特点

通常、ポジションは数時間以内に利益をもたらすことが多いです - 時にはもう少し時間がかかることもありますが、それは稀な例です。これにより、より頻繁に取引し、それによってより多くの利益を得ることができます。

ロボットは高い取引精度を持ち、他のほとんどのロボットを凌駕しています。これは、AUDCADで特定のパターンを識別し、価格の動きのかなり正確な範囲を決定することによって達成されます。

トレンドに沿った取引を優先します。

このアプローチは、私たちが一意な特徴に焦点を当てずにすべてのペアに異なる設定を集中させることなく成功するのに役立ちました。代わりに、AUDCADという1つのペアに焦点を当て、その最大のポテンシャルを引き出すことに決めました。その後、EURUSDでも同じことをし、それがエレベーテッドプロファイルのアイデアが生まれた経緯です。

FX FastBotロボットを購入すると、両バージョンを入手し、MetaTrader 4およびMetaTrader 5プラットフォームの両方で取引することができます - すべてがあなたの利便性のためです。

口座の安全性が最も重要です。そのため、当社のロボットにはドローダウンの制限があり、設定した範囲を超えて損失を被ることを許しません。ただし、4つのユニークなプロファイルすべてで実際の口座で取引した後、ドローダウン(ストップロス)を制限する必要はありませんでした。

購入に含まれるもの:

- 各账户使用许可证

- 在线更改帐号号码的机会

- MT4和MT5两个机器人版本

- 免费及时更新

- 详细的用户指南

- 快速专业的全年无休支持

FX FastBot Advanced - 429$

- 稳健配置(V1): AUDCAD

- 稳健配置(V2): AUDCAD

- 保守配置: AUDCAD

- 高级配置: AUDCAD, EURUSD

FX FastBot - 369$

- 稳健配置(V1): AUDCAD

退款政策

购买后30天内全额退款。如果我们的EA无法在您的帐户上正常运行且无法解决问题,我们将退款。如果帐户余额减少35%以上,并且您使用我们的建议设置并提供证明,我们也会进行退款。

Recensione FX FastBot

FX FastBot EA以其一致的盈利能力和对交易的结构化方法引起了关注。它是为高频交易而开发的,主要关注AUDCAD,并利用平均逆转和趋势跟随策略。这款EA经过数年的实时表现验证和令人印象深刻的风险管理,旨在通过最小限度的暴露实现稳定的盈利。但是,在实际的实时市场中,它到底能够运作得多好呢?在这篇外汇机器人评论中,我们将分析其策略、结果和潜在弱点。

关于 FX FastBot Advanced 的基本信息:

- 价格$369-429

- 货币对AUDCAD, EURUSD

- 实际许可证数量每个帐户一个许可证

- 支持24/7

- 退款购买后的前30天内全额退款保证

交易条件:

- 最低存款金额$600

- 时间范围Any

- 终端MT4 and MT5

- 经纪人Any

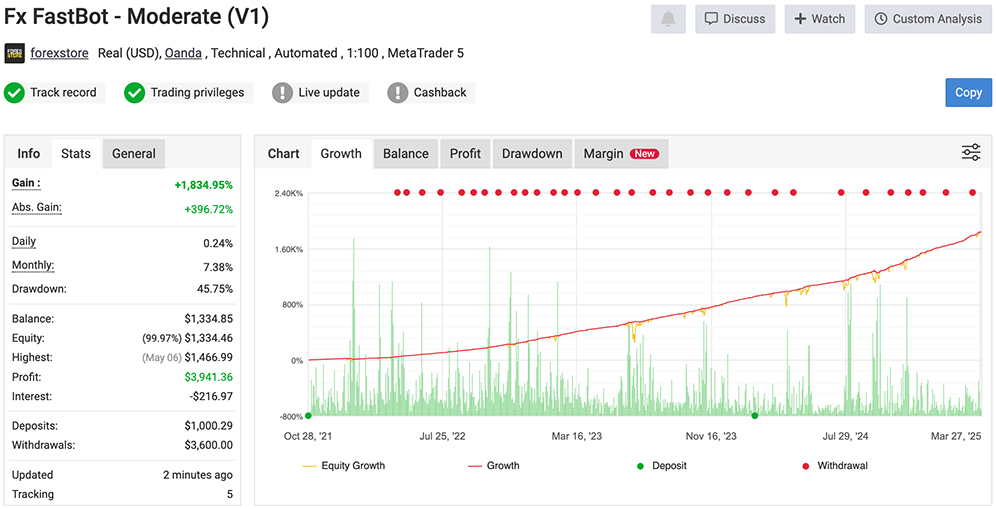

FX FastBot Advanced 的实时表现

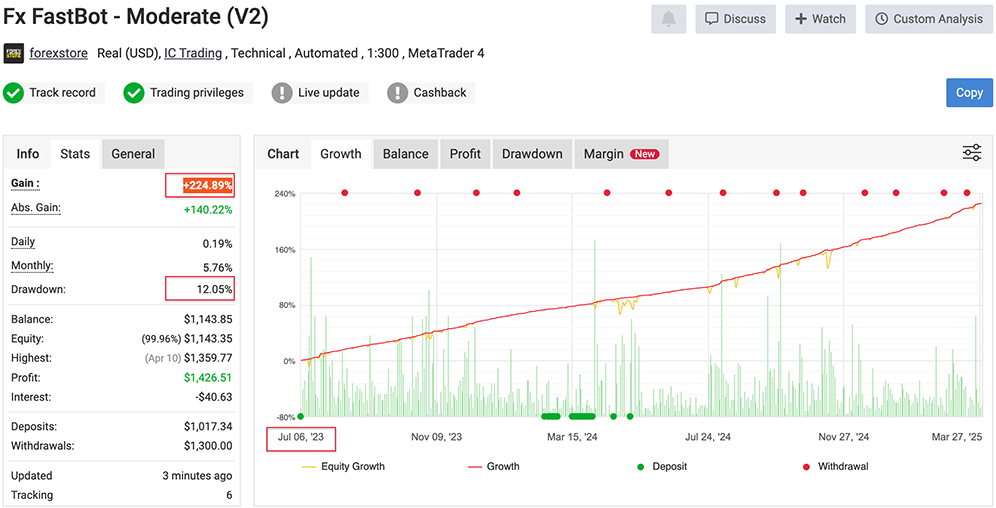

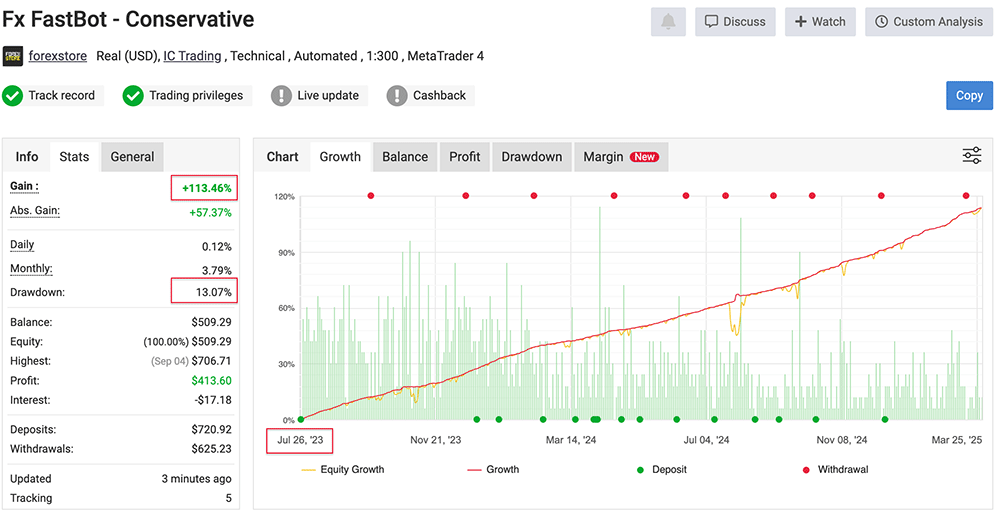

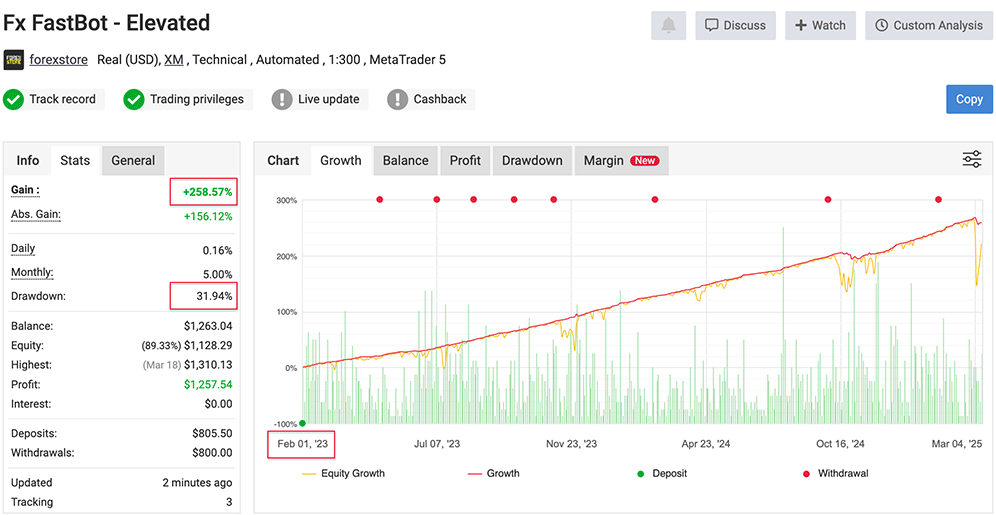

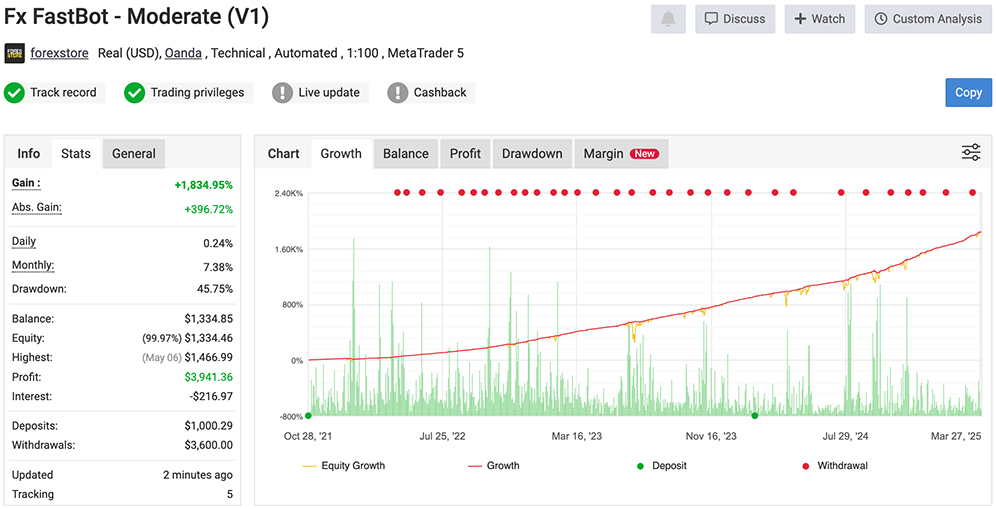

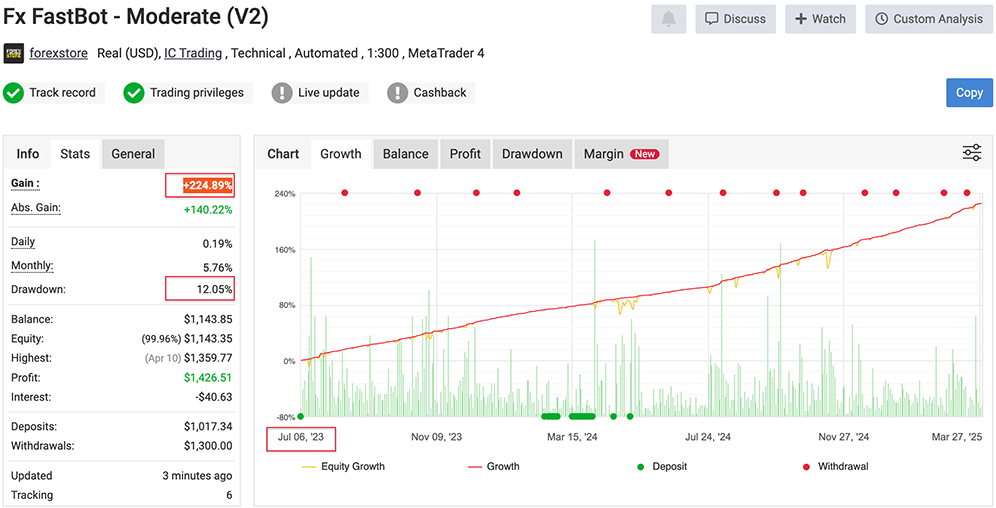

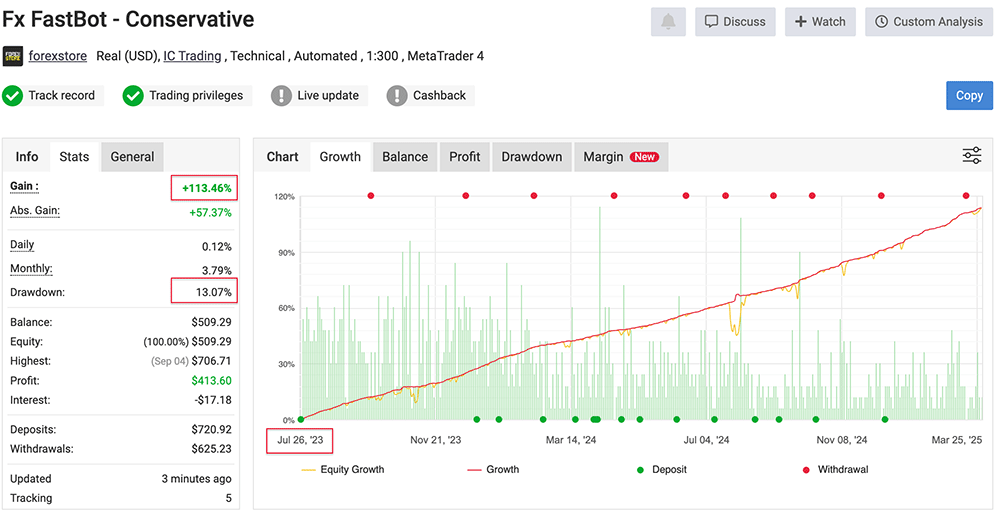

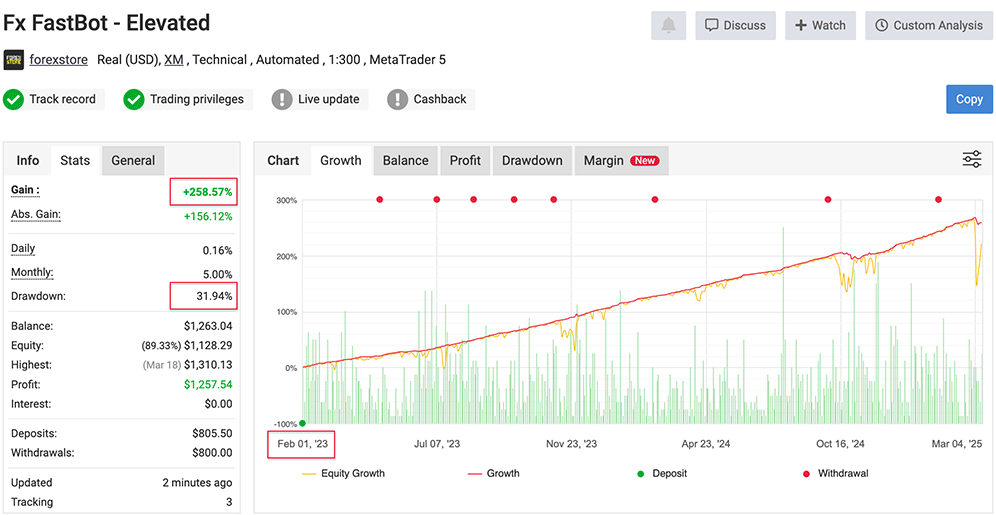

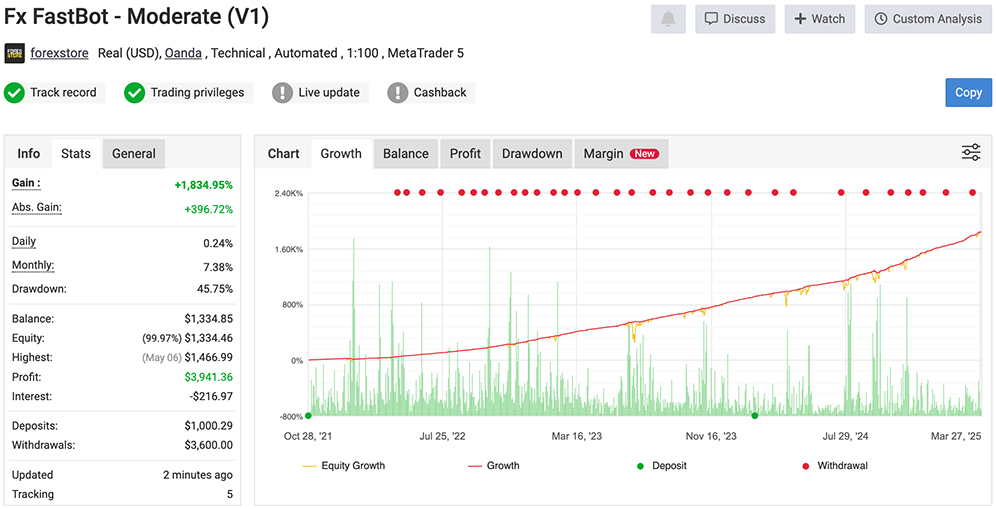

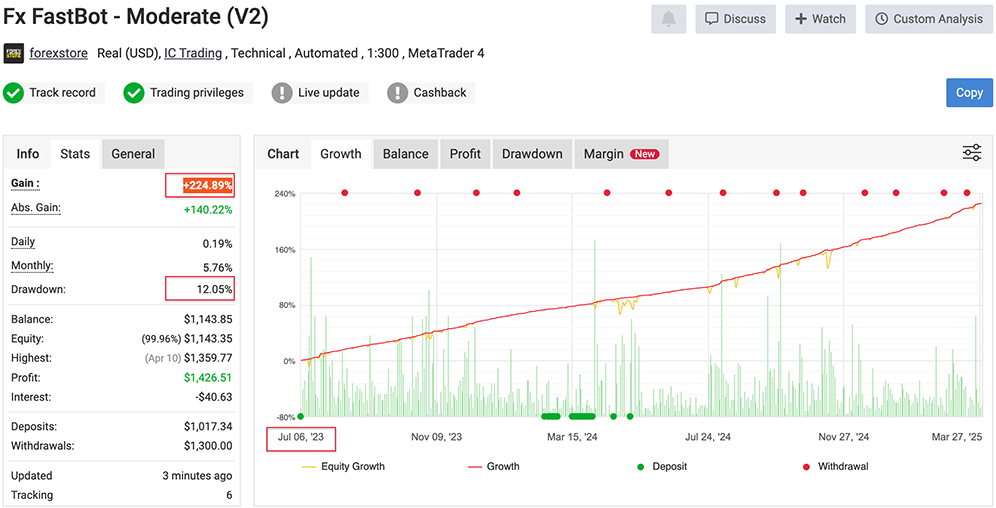

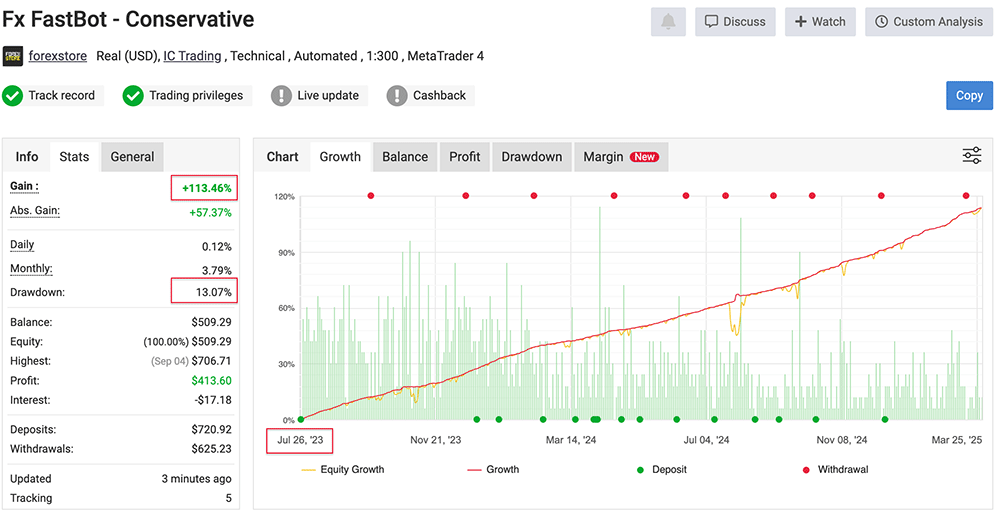

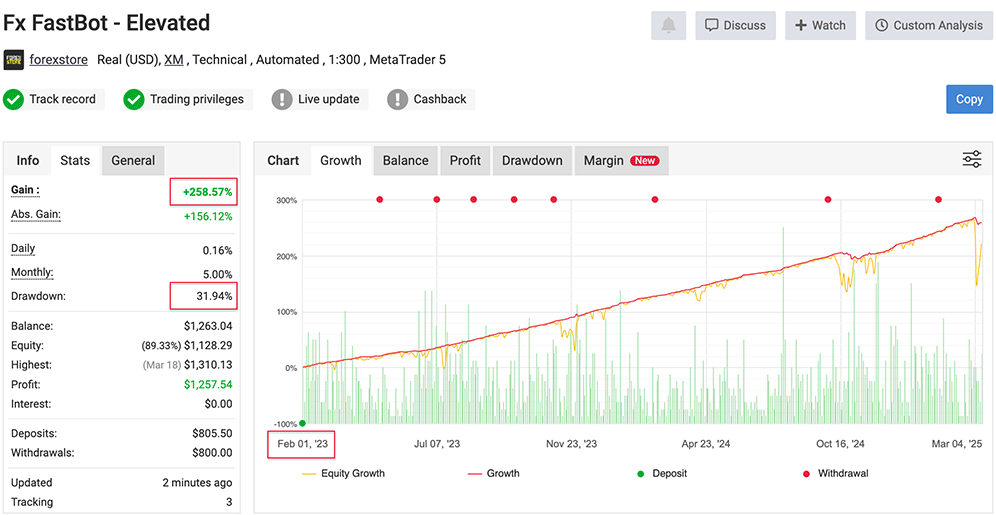

FX FastBot EA has four live trading accounts tracked on Myfxbook, an independent platform that provides verified trading performance data. The Moderate (V2) and Conservative accounts were launched in July 2023, while the Elevated account began in February 2023. The longest-running account, Moderate (V1), has been active since October 2021. Most of these accounts trade the AUDCAD currency pair, except for the Elevated account, which also includes EURUSD. The performance graphs appear smooth and consistent, with all accounts showing a strong upward trend, reflecting the robot’s profitability.

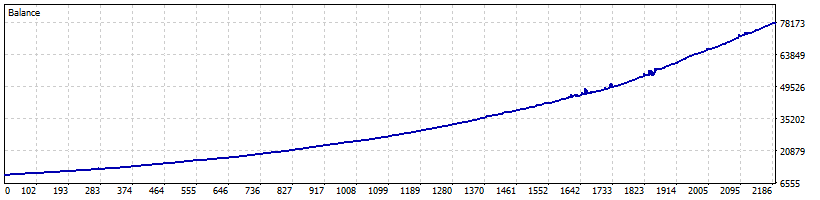

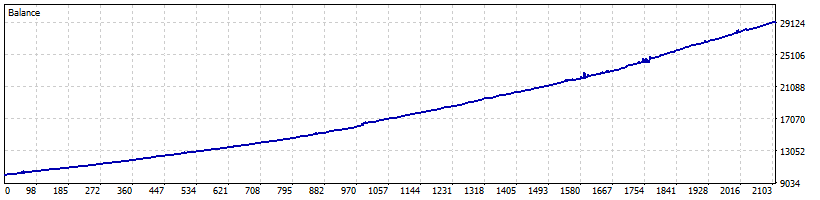

FX FastBot EA has undergone extensive backtesting, covering eight different scenarios. The developers ensured that every operating mode was thoroughly tested. Each supported performance mode was evaluated using both Safe MM and Normal MM trading strategies, based on historical data from 2021 to 2025.

All tests were conducted using the standard Myfxbook backtester on the 1H timeframe with 90% accuracy. This level of precision is sufficient for the EA, as it does not rely on scalping and does not require tick-by-tick data for effective operation. The results indicate that the EA has demonstrated consistent and stable performance throughout the tests.

免责声明

*回测数据来自 developers’ website 开发者的网站

*随后对智能交易顾问的分析基于 Myfxbook 网站的实时分析。我们将分析该交易系统的优缺点,以及盈利和回撤情况。

盈利和回撤

FX FastBot EA 有两个版本可用:

- FX FastBot – 价格为$369,此版本仅可访问 Moderate 档案 (V1)。此档案专注于 AUDCAD 货币对的交易。

- FX FastBot Advanced – 可以购买的价格为$429,此版本包含 Moderate (V1)、Moderate (V2)、Conservative、Elevated 四个档案。大多数档案交易 AUDCAD,但 Elevated 档案也包括 EURUSD。

如上所述,EA 在 Myfxbook 上的 4 个实时交易账户上交易。其中 3 个专注于 AUDCAD,1 个交易 EURUSD。表现最佳的账户是 FX FastBot - Moderate (V1),在超过 3 年半的活动期间内实现了 1,834.95% 的利润,并记录了 最大45.75% 的波动性回撤。

分析表现最佳的 Moderate (V1) 实时账户的绩效数据,考虑其长期交易历史,可以估计出大约 1:1 的利润与回撤比率。

其他 3 个账户的收益率较低,但超过了外汇机器人的平均水平:

- Moderate (V2) – 在 AUDCAD 上活动了 21 个月,实现了 224.89% 的利润,记录了 最大12.05% 的波动性回撤。因此,大约为 1:1.1 的利润与回撤比率。

- 保守的 - 在 AUDCAD 上交易了 21 个月,实现了 113.46% 的利润,记录了 13.07% 的回撤,利润与回撤的比率约为 1:2。

- 增加 - 活动了 26 个月,交易了 EURUSD 和 AUDCAD,实现了 258.57% 的利润,记录了 31.94% 的回撤,利润与回撤的比率约为 1:3.2。

盈利和回撤

FX FastBot EA 有两个版本可用:

- FX FastBot – 价格为$369,此版本仅可访问 Moderate 档案 (V1)。此档案专注于 AUDCAD 货币对的交易。

- FX FastBot Advanced – 可以购买的价格为$429,此版本包含 Moderate (V1)、Moderate (V2)、Conservative、Elevated 四个档案。大多数档案交易 AUDCAD,但 Elevated 档案也包括 EURUSD。

如上所述,EA 在 Myfxbook 上的 4 个实时交易账户上交易。其中 3 个专注于 AUDCAD,1 个交易 EURUSD。表现最佳的账户是 FX FastBot - Moderate (V1),在超过 3 年半的活动期间内实现了 1,834.95% 的利润,并记录了 最大45.75% 的波动性回撤。

分析表现最佳的 Moderate (V1) 实时账户的绩效数据,考虑其长期交易历史,可以估计出大约 1:1 的利润与回撤比率。

其他 3 个账户的收益率较低,但超过了外汇机器人的平均水平:

- Moderate (V2) – 在 AUDCAD 上活动了 21 个月,实现了 224.89% 的利润,记录了 最大12.05% 的波动性回撤。因此,大约为 1:1.1 的利润与回撤比率。

- 保守的 - 在 AUDCAD 上交易了 21 个月,实现了 113.46% 的利润,记录了 13.07% 的回撤,利润与回撤的比率约为 1:2。

- 增加 - 活动了 26 个月,交易了 EURUSD 和 AUDCAD,实现了 258.57% 的利润,记录了 31.94% 的回撤,利润与回撤的比率约为 1:3.2。

盈利和回撤

FX FastBot EA 有两个版本可用:

- FX FastBot – 价格为$369,此版本仅可访问 Moderate 档案 (V1)。此档案专注于 AUDCAD 货币对的交易。

- FX FastBot Advanced – 可以购买的价格为$429,此版本包含 Moderate (V1)、Moderate (V2)、Conservative、Elevated 四个档案。大多数档案交易 AUDCAD,但 Elevated 档案也包括 EURUSD。

如上所述,EA 在 Myfxbook 上的 4 个实时交易账户上交易。其中 3 个专注于 AUDCAD,1 个交易 EURUSD。表现最佳的账户是 FX FastBot - Moderate (V1),在超过 3 年半的活动期间内实现了 1,834.95% 的利润,并记录了 最大45.75% 的波动性回撤。

分析表现最佳的 Moderate (V1) 实时账户的绩效数据,考虑其长期交易历史,可以估计出大约 1:1 的利润与回撤比率。

其他 3 个账户的收益率较低,但超过了外汇机器人的平均水平:

- Moderate (V2) – 在 AUDCAD 上活动了 21 个月,实现了 224.89% 的利润,记录了 最大12.05% 的波动性回撤。因此,大约为 1:1.1 的利润与回撤比率。

- 保守的 - 在 AUDCAD 上交易了 21 个月,实现了 113.46% 的利润,记录了 13.07% 的回撤,利润与回撤的比率约为 1:2。

- 增加 - 活动了 26 个月,交易了 EURUSD 和 AUDCAD,实现了 258.57% 的利润,记录了 31.94% 的回撤,利润与回撤的比率约为 1:3.2。

最终成绩

FX FastBot EA具有两个版本,可满足不同的交易需求,并提供高性价比。标准版本($369)提供了经过验证的Moderate-Profil(V1)的访问权限,而高级版本($429)包含4个配置文件,增加了多样化。考虑到长期盈利能力、有效风险管理和对交易的结构化方法,与许多其他不一致的EA相比,其价格是完全合理的。

根据实时交易数据,FX FastBot EA在受控亏损率方面提供了高回报。表现最佳的Moderate(V1)账户的最大变动亏损率为45.75%,反映了1:1的盈利与亏损的稳健比率,并获得了超过1800%的利润。其他配置文件显示,根据风险,它们展示了更好的回报,并表明了在EA不同风险水平下维持盈利能力的能力。

42个月的实时交易历史表明,FX FastBot EA经受住了时间的考验。许多EA最初表现出有希望的结果,但在长期内失败。然而,该机器人在各种市场状况下保持稳定的表现,并增强了其可靠性。长期统计数据确认了其作为可持续交易解决方案的有效性。

EA经过了各种场景的全面回测,覆盖了Safe MM和Normal MM风险设置。使用自2021年至2025年的高质量历史数据进行测试,确认了策略在不同市场阶段也是强大的。结果与实时交易表现密切匹配,确认了EA的一致性和适应性。

经过仔细验证FX FastBot EA的结果,该系统在盈利能力、风险管理和长期一致性方面获得了高度评价。尽管其表现优异,但也存在缺点。该机器人可能会在强劲的趋势中遇到困难,并且倾向于持有亏损交易的时间比获利交易长。尽管如此,FX FastBot EA仍然是当今最可靠的专家顾问之一。

在此評論創建時,ForexStore的自動評分系統將FX FastBot EA評為滿分10分。這與該評論的平均評分非常接近。希望對交易者有所幫助!祝您交易盈利,市場幸運!